More than $4 billion in securitized auto loans were granted lender extensions in March, as car owners struggled with keeping up with their payments amid fast-rising jobless claims resulting from the economic fallout of COVID-19.

According to a new report from S&P Global Ratings, approximately 236,000 auto-loan borrowers received extensions granting them payment holidays of between 30 and 120 days on their notes.

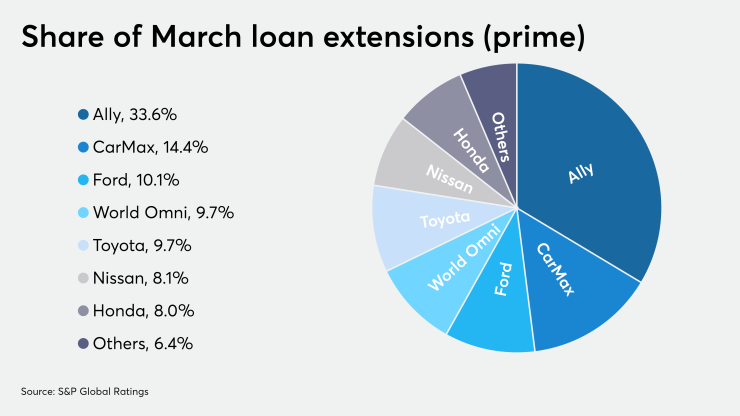

The extensions were littered across the spectrum of prime- and non-prime loans, but were more concentrated with particular lenders – such as Ally Bank after it introduced a more “liberal” payment holiday policy for borrowers, S&P noted.

The figures reported for March occurred during a surge of 10 million unemployment filings nationwide that month, as non-essential business closings took place to accommodate shelter-in-place mandates by municipal and state governments. That jobless claims number has swollen to approximately 30 million as of April 30.

Prime lenders granted extensions on 144,000 loans that – on a dollar basis – equaled 3.94% of outstanding loans included in U.S. auto-loan asset-backed securities, according to S&P. That was more than 12 times the February figure of 0.33% for that subset of issuers, which are mostly U.S. captive-finance arms for automakers including Ford, General Motors, Honda and Toyota.

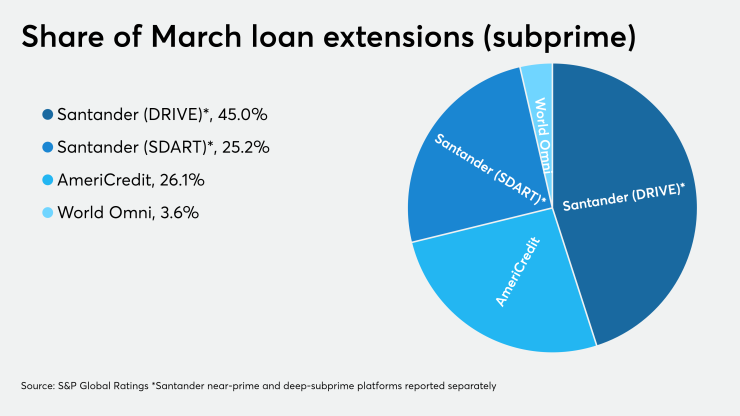

The spike was not as pronounced for subprime loans, increasing four times to 6.82%…but the month-over-month change of 5.29% was steeper, impacting 82,000-plus non-prime loans with a combined balance of $1.61 billion on higher-APR, slower-amortizing balances.

That compared to $2.56 billion in prime auto-loan balances impacted by extensions.

Subprime lenders on average had larger extension rates. The largest was for the nonprime ABS shelf of World Omni Financial Corp., a Florida-based lender with 47% of its subprime loan activity concentrated in its home state where the travel and leisure industry has been crippled by the coronavirus pandemic.

World Omni also has a relatively high extension rate of nearly 6% for the prime-quality loans it underwrites as a captive-finance partner regional Toyota dealers in its five-state Southeast regional footprint.

The majority of prime-loan extension requests (34%) were handed out by Ally, even though the lender has only 11% of active loans held in U.S. prime auto ABS transactions. Ally’s extension rate exceeded 12% after the company (a subsidiary of $182 billion-asset Ally Financial) announced in mid-March it “would defer payments for auto customers for up to 120 days, which was more liberal than most of their peers,” S&P’s report stated.

(Ally, which derives three-quarters of its net revenues from auto finance, announced in its first-quarter earnings that it has set aside $903 million for future loan losses).

For most of the remaining auto ABS issuers, loan-relief actions were proportionate across the prime and subprime credit spectrum, according to S&P.

Borrowers financing new luxury cars through the U.S. captive-finance arms of Mercedes-Benz, for example, were granted extensions at the same clip (just over 4%) as poor-credit buyers of used vehicles gained relief from non-prime lenders such as First Investors, Exeter Finance or AmeriCredit.

The similarities may not be indicative of equal levels of distress, however.

Extensions represent payment deferrals that are tacked on to the end of loan contracts, and often include accrued interest during that time – which would not be a major concern for a prime auto-loan borrower paying a subsidized car-note with an APR between zero and 1.9%, according to S&P. (Captive finance lenders may also offer extensions as a new-purchase incentive or as a ploy for future customer loyalty).

But for a subprime borrower, loan extensions most likely mean high-interest deferrals at the tail end of lengthy contract on a used vehicle for which they lack equity for a significant portion of the loan term, S&P’s report stated. “It may be more prudent for those customers to make the payments when due if possible rather than extend the loan and have large amounts owing at the end of the loan term,” the report stated.