-

The ratings company raised the airline's long-term rating to BBB- from BB+, according to a statement Wednesday, citing improved cash flow and robust passenger demand. IAG beat expectations with its second-quarter earnings at the end of July.

October 4 -

Over 236,000 prime and subprime vehicle-loan borrowers received payment deferrals of between 30 and 120 days during the early economic turmoil of the coronavirus pandemic, according to the ratings agency.

May 4 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

According to a new academic research report, CLO managers have taken advantage of S&P's ratings methodology for a ratings boost on lower-rated tranches - enabling them to offer more return for what seemed like less risk.

April 21 -

The ratings agency on Wednesday placed whole-business securitizations from Applebee's/IHOP, TGI Friday's and Planet Fitness under review for potential downgrades.

March 25 -

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The company asserted in the statement that S&P’s action was driven more by the distressed trading levels of Serta’s loans in the secondary market rather than the company’s “financially solvent” status.

December 30 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 3 -

In a report issued Wednesday, S&P published its base forecast 12-month trailing default rate at 3.9% by September 2020, from the 2.8% rate in September 2019.

November 20 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

S&P stated that as more loans stretch into 72 months or even 84 months as a result of rising new-vehicle prices, auto ABS investors must be mindful of increased credit risks that accompany extended-term loans.

July 30 -

Revisions to S&P's CLO ratings methadology and Kroll's launch into rating European CLOs could challenge Moody's as the first choice for managers across the pond.

June 25 -

The 240 note classes under review from 24 issuers include several already holding high-risk triple-C ratings.

May 14 -

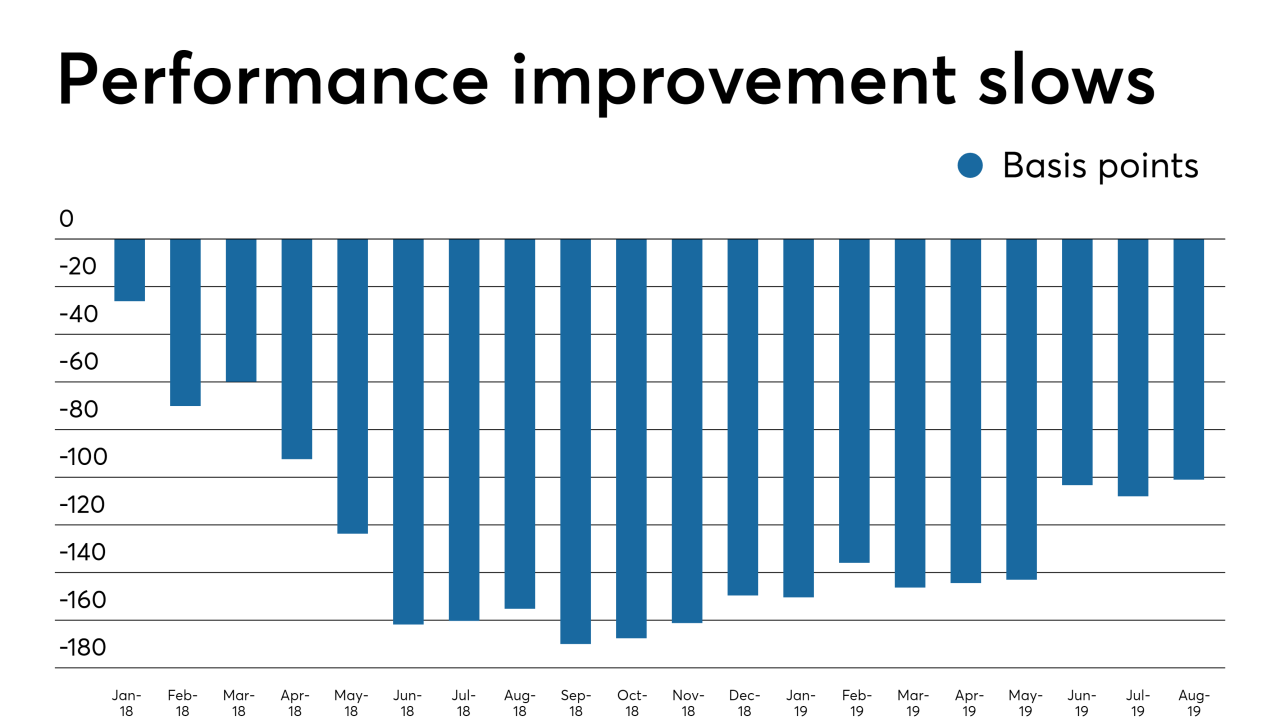

S&P says extended term loans and "liberal" collection policies are pushing losses and amortization toward the tail end of some lenders' securitizations — making cross-comparing performance between lenders and an issuer's own outstanding vintage deals more difficult.

August 26 -

The U.S. CLO manager breaks the ice with its first euro-denominated deal, which priced Friday and will close in May when it is about 75% ramped up.

March 27 -

The deadline to appeal the rollback of risk-retention requirements for CLO managers expired at midnight last night, but Voya Alternative Asset Management is not taking advantage.

March 26 -

Octagon is refinancing a 2013-vintage CLO for the second time, while Anchorage is using the assets of a deal issued in 2012 (and later refinanced in 2016) for its first new-issue deal of 2018.

March 20 -

CBAM, the leading CLO issuer by volume in 2017, had a shorter non-call for its senior-note stack; Apex has split the AAA paper into three variable-priced tranches.

March 15 -

Two privately placed static CLOs and the newly priced Palmer Square CLO 2018-1 add up to more than $1.5 billion in new CLO assets under management for the Kansas City-metro area manager.

March 14 -

The €413 million transaction will issue exchangeable notes for the five senior tranches, allowing regulated U.S. banks the opportunity to invest, even though the portfolio includes bonds.

March 13