-

The concentration of loans with terms of 73-75 months has breached 13%, after ranging from between 10-12% from five previous AART issues since 2016.

June 18 -

Record originations on "better-yielding" used-car loans helped drive a 14% increase in its first-quarter profit. But Ally's shares were down Thursday on concerns of rising deposit costs.

April 26 -

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The first prime auto-loan securitizations for Ally Bank and captive-finance lenders for Toyota and Ford total $3.5-$4B, according to rating agency presale reports.

January 18 -

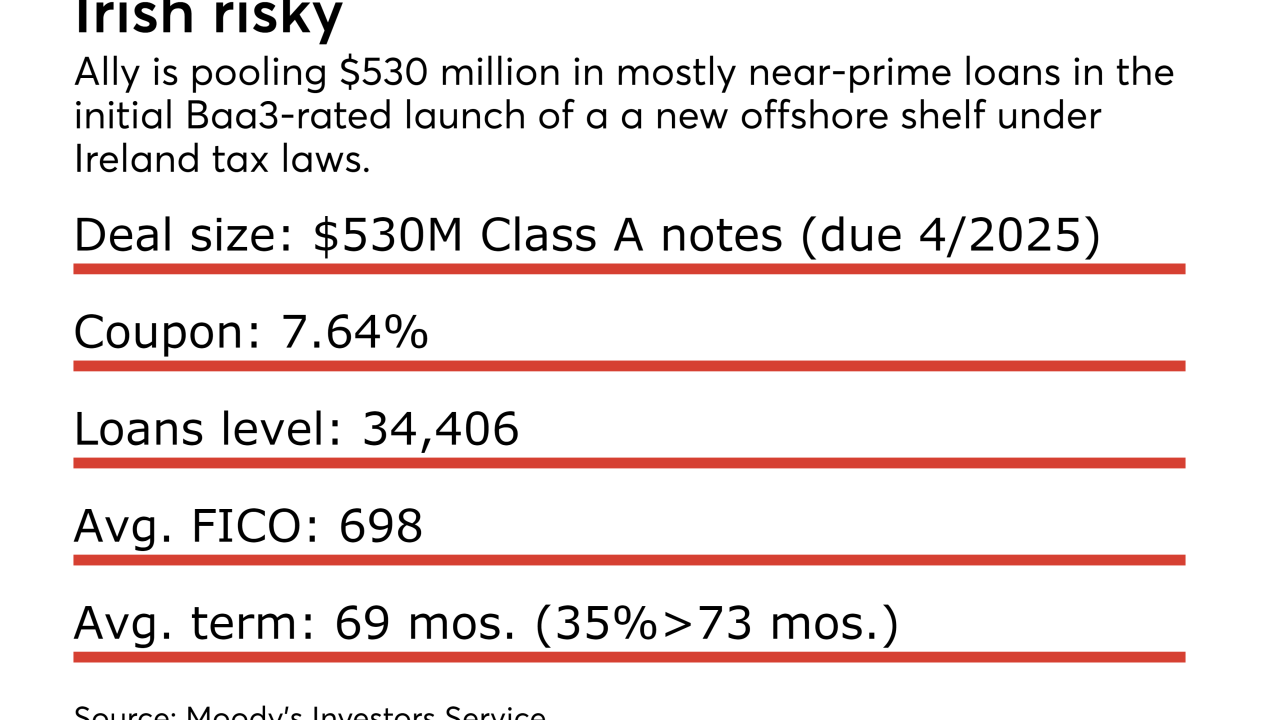

Juniper Receiveables DAC, a new offshore shelf for Ally U.S. auto-loan receivables, has received an early 'Baa3' rating from Moody's Investors Service on its initial $530 million issuance.

November 14 -

The commitments were the residue of restrictions that were placed on Ally in the wake of government bailouts in 2008 and 2009.

August 22