Ally Bank has garnered the lowest-available investment grade rating for the debut offering of its new offshore securitization platform featuring extended-length, near-prime auto loans.

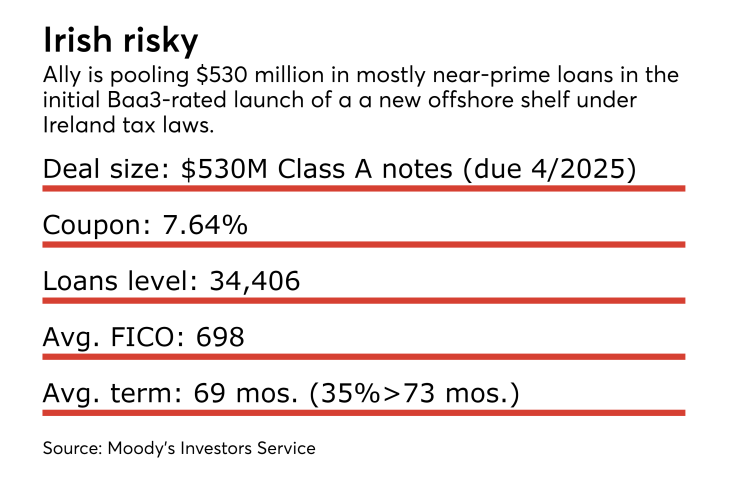

Juniper Receivables DAC (designated activity company) has received a preliminary Baa3 from Moody’s Investors Service for the single-tranche of Class A notes totaling $530 million.

Ally and other issuers (both prime and subprime) routinely obtain triple-A ratings even for the riskiest of securitizations. But Juniper’s unusually low grade stems from a low overcollateralization level as well as an expected low excess spread level due to the fees and expenses from servicing these notes that carry a lengthy eight-year legal maturity, according to Moody’s presale report published Monday.

“If losses increase in the deal, higher losses can quickly erode the amount of collateral, therefore deplete the excess spread and lower the total enhancement available to the notes,” Moody’s report stated.

“Our assigned note rating has taken into consideration of the low excess spread and the existing hard enhancement presented in the transaction.”

The coupon on the notes that have an April 2025 maturity is 7.64%.

Moody’s expects a 3% cumulative net loss over the life of the deal.

The 34,406 U.S. loans Ally has assigned to the pool are derived from the same $2.2 million managed portfolio of loans used to feed its prime securitization shelf (Ally Auto Receivables Trust). But most of these loans tasked to the Juniper shelf have slight chinks in the armor: excessive term lengths averaging 69 months, a higher average APR of 9.1% (compared to AART’s 5.72% in its most recent transaction) and a weighted average FICO of 698.

More than 35% of the loans exceed 73-month original terms, and most of the loans (60%) were originated to borrowers with FICO scores between 651 and 700. The loans are split evenly among new and used vehicles.

The new Juniper shelf is taking on the riskier loans of a portfolio that is seeing rises in delinquencies and losses, although nowhere near historical crisis-era levels. Total delinquencies were up to 3.05% at the end of the third quarter — an increase of 24 basis points — and charge-offs were up to 1.45% from 1.37%, although those are lower levels than expected since Ally and other automakers have instituted payment relief and repossession moratoriums this fall in hurricane-damaged regions.

According to the presale report, the notes are supported by an initial hard 6.7% credit enhancement level, consisting of a 6.45% initial OC level and a 0.25% reserve fund. The OC level is expected to build to 7.45%. The most recent triple-A rated AART deal had an initial 5.85% level (Ally

Ally’s subprime loan securitization shelf, Capital Auto Receivables Asset Trust, received triple-A ratings on shorter term notes (3-5 years) with 14.5% CE in its lone 2017 deal that priced in October.

Citigroup is the lead underwriter of the transaction.