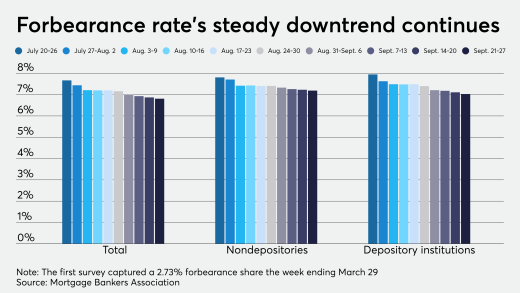

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

The 1,400-store chicken wings chain, which has benefited from carry-out dining trends during the pandemic, will sponsor its second whole-business securitization since 2018.

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

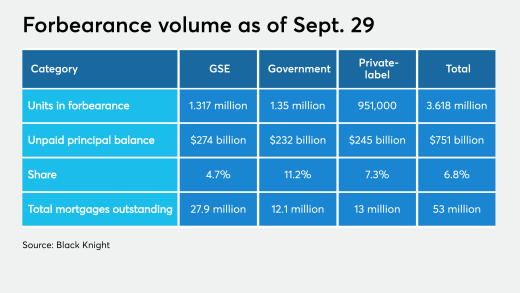

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

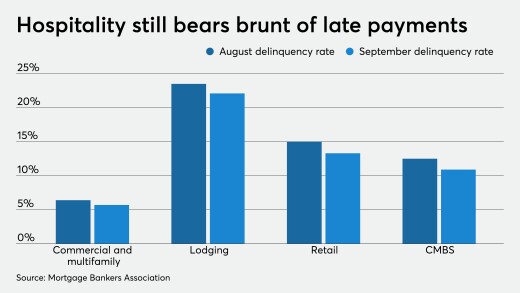

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

-

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

October 9 -

The 1,400-store chicken wings chain, which has benefited from carry-out dining trends during the pandemic, will sponsor its second whole-business securitization since 2018.

October 8 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1