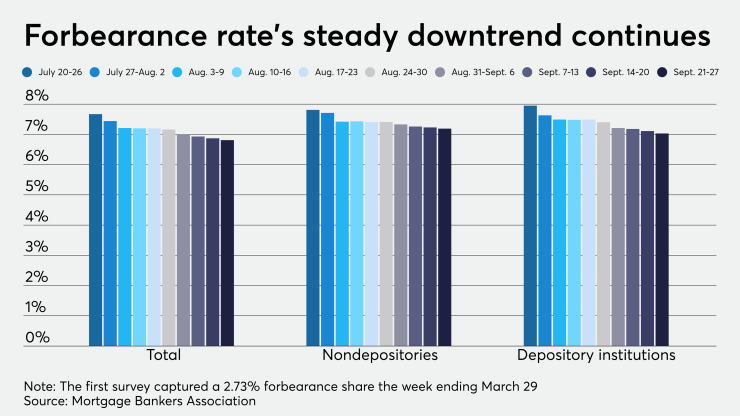

Mortgages entering coronavirus-related forbearance continued their consistent decline as the rate dropped 6 basis points between Sept. 21 and 27, according to the Mortgage Bankers Association.

Mortgages in forbearance plans represented 6.81% — about 3.4 million — of all outstanding loans, compared with 6.87%

"As of the end of September, there continues to be a slow and steady decrease in the share of loans in forbearance — driven by consistent declines in the GSE loan share — and a

The forbearance share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — dropped for the 17th consecutive week, going to 4.39% from 4.46%. Ginnie Mae loans —

Private-label securities and portfolio loans in forbearance — products not addressed by the coronavirus relief act — shot up, rising to 10.39% from 10.52%.

A 70.07% share of all forborne mortgages sit in extended plans, with 28.5% in the initial forbearance stage, and the remaining 1.43% re-entering forbearance after a previous exit.

Forbearance requests as a percentage of servicing portfolio volume decreased to 0.08% from 0.11%, while call center volume as a percentage of portfolio volume went to 6.8% from 8.3%.

The MBA's sample for this week's survey includes a total of 50 servicers with 26 independent mortgage bankers and 22 depositories. The sample also included two subservicers. By unit count, the respondents represented about 74%, or 37.1 million, of outstanding first-lien mortgages.