The lease/purchase home operator is securitizing a loan with higher debt-service coverage that most prior MBS issues from its trust. It also is providing a geographically diverse mix of homes that make the deal less vulnerable to isolated outbreak hotspots.

Automotive services chain operator Driven Brands is pursuing its next whole-business securitization, despite a recent sales decline among its franchise stores due to slowing economic conditions related to the pandemic.

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

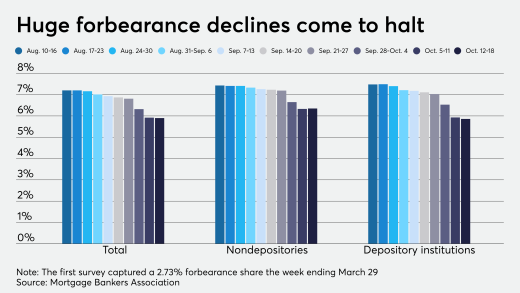

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

Lenders have spent months puzzled by the persistently low delinquencies on their credit cards. Now, they’re seizing the moment.

With the COVID-19 pandemic creating unprecedented challenges for small businesses, American Express has increasingly targeted its investments in that niche.

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

The U.S. economy continued to grow across the country as it recovered from the coronavirus pandemic, but the picture was uneven, according to a new report from the Federal Reserve.

-

The lease/purchase home operator is securitizing a loan with higher debt-service coverage that most prior MBS issues from its trust. It also is providing a geographically diverse mix of homes that make the deal less vulnerable to isolated outbreak hotspots.

October 29 -

Automotive services chain operator Driven Brands is pursuing its next whole-business securitization, despite a recent sales decline among its franchise stores due to slowing economic conditions related to the pandemic.

October 28 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

Lenders have spent months puzzled by the persistently low delinquencies on their credit cards. Now, they’re seizing the moment.

October 23 -

With the COVID-19 pandemic creating unprecedented challenges for small businesses, American Express has increasingly targeted its investments in that niche.

October 23 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21