Progress Residential is bringing its next securitization of single-family rental properties to market, even as concerns mount on the depth of pandemic-driven tenant forbearance and delinquency trends.

The Federal Housing Finance Agency clarified that borrowers with Fannie Mae- or Freddie Mac-backed mortgages who have entered into forbearance plans can be eligible for a refi or new purchase once they are considered “current” on their mortgage.

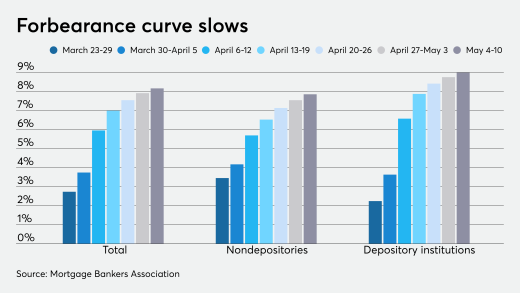

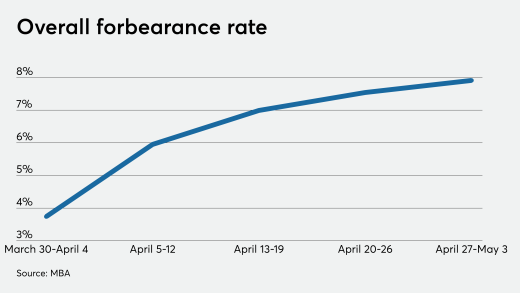

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold in response to issuers' need to fulfill the forbearance requirements in the coronavirus rescue package.

First Republic is preparing a private-label residential mortgage-backed securities transaction and could be the first bank to launch this type of deal since the coronavirus first roiled U.S. markets in mid-March.

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

Eligible borrowers can add the forborne payments to the end of their loan term.

-

Progress Residential is bringing its next securitization of single-family rental properties to market, even as concerns mount on the depth of pandemic-driven tenant forbearance and delinquency trends.

May 19 -

The Federal Housing Finance Agency clarified that borrowers with Fannie Mae- or Freddie Mac-backed mortgages who have entered into forbearance plans can be eligible for a refi or new purchase once they are considered “current” on their mortgage.

May 19 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold in response to issuers' need to fulfill the forbearance requirements in the coronavirus rescue package.

May 18 -

First Republic is preparing a private-label residential mortgage-backed securities transaction and could be the first bank to launch this type of deal since the coronavirus first roiled U.S. markets in mid-March.

May 15 -

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

May 15 -

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

May 14