-

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

First Republic is preparing a private-label residential mortgage-backed securities transaction and could be the first bank to launch this type of deal since the coronavirus first roiled U.S. markets in mid-March.

May 15 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 2 -

The agency is sending a strong message that it won’t rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

Though advocates and industry are rarely aligned, they are starting to coalesce around a plan that would call for the elimination of the CFPB’s 43% debt-to-income limit as part of its qualified mortgage rule.

August 27 -

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

With the agency mulling changes to the “Qualified Mortgage” regulation, mortgage lenders say little-known standards for how they document a borrower’s income would be a good place to start.

August 12 -

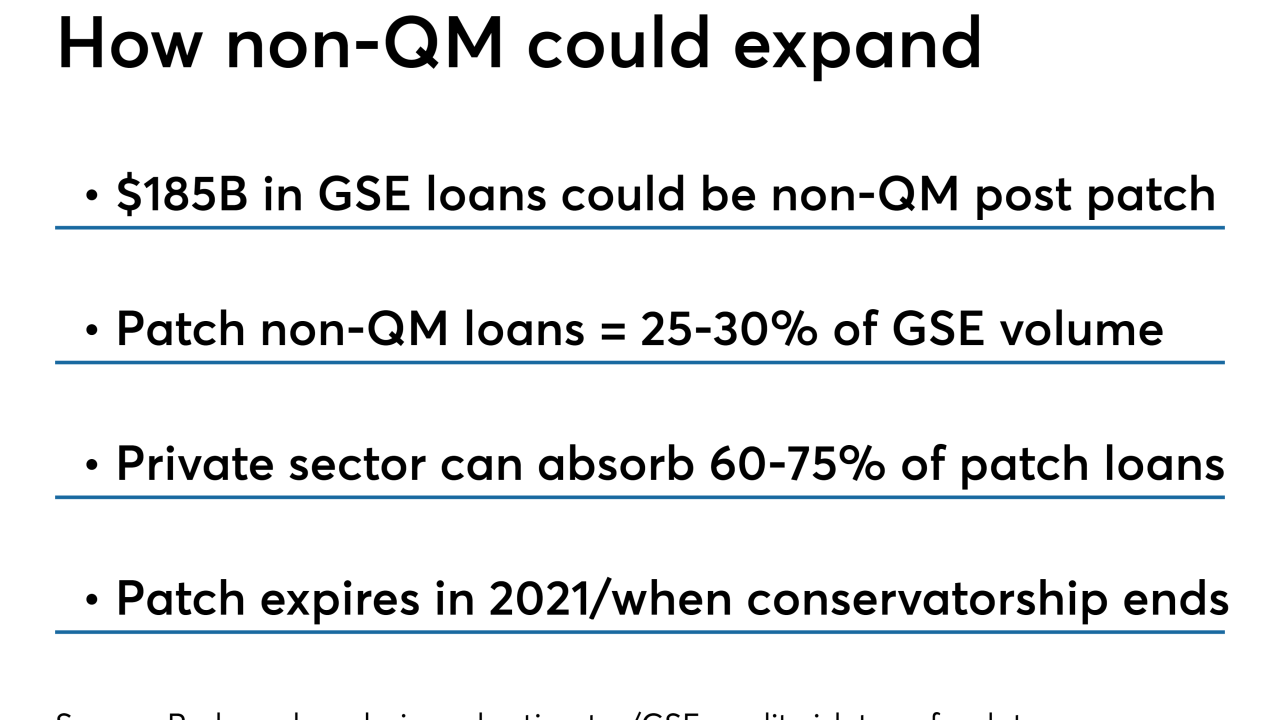

A gradual approach would help the market absorb loans affected by the government-sponsored enterprises' expiring qualified mortgage exemption, a Redwood Trust executive told analysts during a recent earnings call.

August 5 -

Many in the industry say releasing GSE-backed loans from stringent underwriting rules has helped the housing market recover, but a new level of regulatory burden could reverse those gains.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

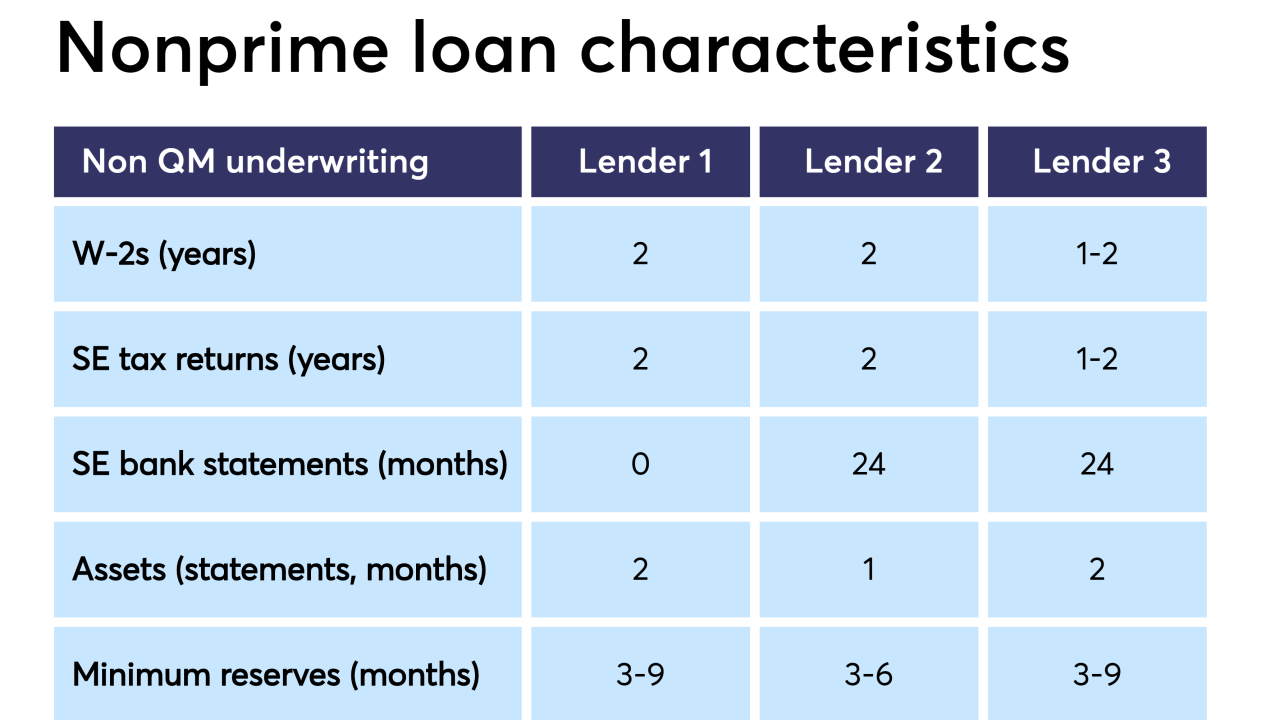

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11