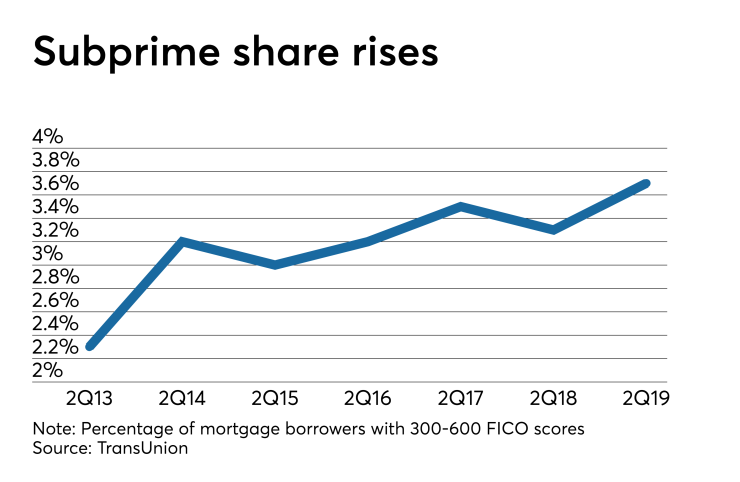

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

The share of home loans made in the second quarter to borrowers with FICO scores in the 300-600 range was 3.7%, TransUnion found in its most recent analysis of origination data. That's up from a post-crisis low of 2% in the first quarter of 2013, and 2.3% in the second quarter that year.

During the same time period, the share of borrowers in the highest credit tier shrunk. Super-prime mortgage borrowers with FICO scores in the 781-850 range took out 28.1% of the loans originated in the second quarter of this year, compared to 35.4% during the same quarter in 2013.

"I think this marks a mild loosening of credit and I suspect it's driven by first-time homebuyers entering into the marketplace," said Joe Mellman, senior vice president and mortgage business leader at TransUnion. "They tend to gravitate more toward the lower credit-score loan programs because they tend to have less credit history."

When asked whether the decrease in the super-prime share of originations and increase in the subprime share are worrisome from a credit perspective, Mellman said, "I don't think that there's a perfect metric across the industry to really gauge that.

"My personal take is as long as housing payments are in line with income and consumers are not overleveraged, we're less likely to move into a bubble and a housing collapse," he added.

While a long-term trend toward looser underwriting bears watching, some volatility in the share of loans made to different segments of borrowers along the credit spectrum is in line with the natural ebb and flow of

Entities like Fannie Mae "are under a constant dual stress," he noted. "On the one hand, there is often a mandate to allow more consumers to become homeowners but on the other hand, there also is one to keep systemic risk low. There is often a healthy tension there."