Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold. The measure is a response to the obligation on issuers to fulfill the forbearance requirements in the

"Ginnie Mae acknowledges that these requirements will cause a significant number of Ginnie Mae issuers to experience increasing delinquency rates that may exceed the maximum thresholds established by Ginnie Mae," the organization said in a bulletin late last week.

In response to that increase, Ginnie may exclude new issuer delinquencies starting with the April data in the May investor accounting report.

The exclusion will be extended automatically to issuers with data that was compliant in the April investor accounting report reflecting March's data, but it can be withdrawn at Ginnie's discretion. Issuers with noncompliant April reports will need to inquire about their eligibility.

Mortgage companies have puzzled over the need to report loans with coronavirus-related forbearance as delinquent to Ginnie Mae and the government-sponsored enterprises, given that the rescue package dictates that payment suspensions not be reported in ways that reflect negatively on consumers' credit histories.

Ginnie Mae normally subjects issuers to sanctions if they have high delinquency rates. If no measures were taken to account for the recent spike in forbearance, the number of issuers sanctioned would likely be quite large: the

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

The percentage of mortgages that have been delinquent for 90 days or more is generally factored into the minimum financial eligibility requirements for single-family loans at the government-sponsored enterprises. The GSEs' regulator had

Currently, if nonperforming loans exceed 6% of a mortgage company's GSE portfolio, the company incurs a charge of an additional 200 basis points toward its minimum liquidity requirements. The forbearance rate for GSE loans has risen above 6%. While the forbearance extended due to the coronavirus crisis has not exceeded the 90-day mark yet, under the terms of the rescue package it could remain outstanding for up to a year.

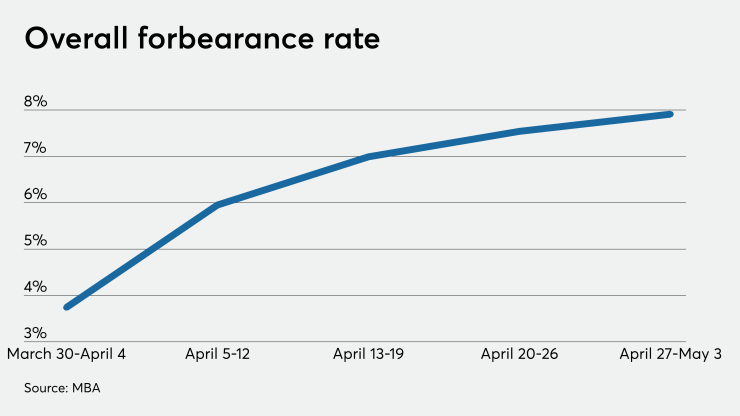

The overall forbearance rate has been rising since the end of March and is now near 8%, but