The central bank will increase support for credit issued through the Main Street Lending Program while providing midsize firms with more flexibility on the amounts they receive.

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

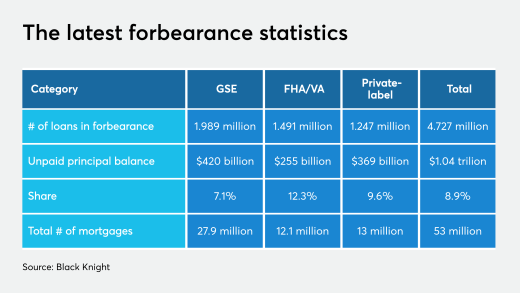

But there was an increase in private-label mortgages in forbearance.

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

The policy comes more than a month after a different agency issued similar guidance for loans backed by Fannie Mae and Freddie Mac.

Fitch Ratings is evaluating all 59 middle-market collateralized loan obligations it rates for potential downgrades, over concerns of the ability of small-business borrowers to support loan payments under COVID-19 stresses.

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

-

The central bank will increase support for credit issued through the Main Street Lending Program while providing midsize firms with more flexibility on the amounts they receive.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 4 -

The policy comes more than a month after a different agency issued similar guidance for loans backed by Fannie Mae and Freddie Mac.

June 4 -

Fitch Ratings is evaluating all 59 middle-market collateralized loan obligations it rates for potential downgrades, over concerns of the ability of small-business borrowers to support loan payments under COVID-19 stresses.

June 4