The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

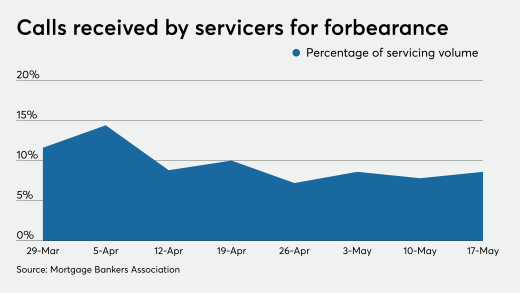

Aggregate numbers for coronavirus-related payment suspensions are showing more consistency as organizations clarify how they handle them, and some consumers' incentives to use them may be declining.

Since March, issuers have tightened their criteria for opening new accounts and closed millions of existing ones in hopes of avoiding waves of defaults.

-

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

June 3 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

Aggregate numbers for coronavirus-related payment suspensions are showing more consistency as organizations clarify how they handle them, and some consumers' incentives to use them may be declining.

May 29