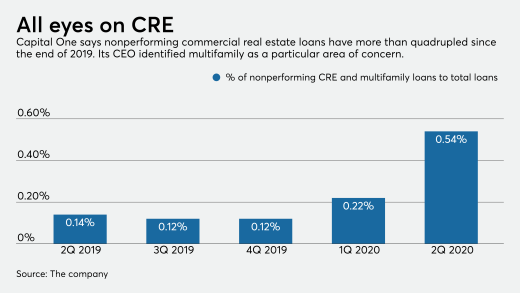

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

-

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

July 21 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17