-

The company allegedly made more than $200 million in "improper payments" before filing Chapter 11 earlier this week, lenders claimed, citing dividends and bonuses to corporate insiders.

January 29 -

The step came after FAT Brands didn't make interest payments due in October on some of its $1.2 billion in whole-business securitization debt.

January 27 -

Origin Bancorp, Renasant Bank and Triumph Financial are the latest financial institutions to report exposure to the bankrupt auto lender Tricolor, joining a list that includes Fifth Third, Barclays and JPMorganChase.

September 11 -

The long-troubled lender owes at least $40 million to mortgage industry counterparties and tax collectors, it said.

June 4 -

The company in a court filing suggests it has funds available for its unsecured creditors, led by a private equity firm, major banks and a servicer.

August 25 -

Bankruptcy courts saw a greater-than-average number of filings in the first quarter, though a year-on-year decline highlights the impact of cheap cash flowing to troubled borrowers.

April 7 -

The delinquency rate on regional mall commercial mortgage-backed securities was 22.9% in February, the highest of any real estate category, according to Moody’s

March 19 -

The Federal Reserve warned of significant risks of business bankruptcies and steep drops in commercial real estate prices in a report published on Friday.

February 19 -

Cheap funding costs have extended a lifeline to many troubled companies, slowing the pace of U.S. bankruptcy filings, but shops, offices and hotels have been particularly vulnerable to the pandemic this month.

January 27 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York’s Upper West Side and Harlem filed for bankruptcy.

December 30 -

The three-year loan will boost the hotel-centered REIT's dwindling cash reserves battered by the COVID-19 global impact on travel.

December 28 -

Investment firms and hedge funds are increasingly engineering bankruptcy loans and side deals to take control of Chapter 11 reorganizations from the outset, locking in rich rewards for themselves while potentially locking out rivals and lower-ranking creditors with little transparency. The trend is sure to speed up cases, but it also forces judges to make quick decisions that may shortchange some valid claims.

December 17 -

The three companies agreed to pay a total of $74 million in remediation.

December 7 -

The proceeds from funds drawn from the notes will be used to replenish the rental car firm's 2021 fleet as it winds through bankruptcy court.

November 27 -

U.S. bankruptcy filings have slowed nearly to a halt, but they’re expected to pick up next year, led by companies that piled on debt to survive this year’s pandemic and election-related volatility.

November 25 -

A spike in coronavirus infections through the U.S. holiday shopping season could trigger more bankruptcies from retailers, even after the biggest surge in Chapter 11 filings on record this year.

November 17 -

Bankruptcy filings hit a three-month high as investors brace for economic shifts from the U.S. election that could force more large corporations to seek protection from creditors.

November 3 -

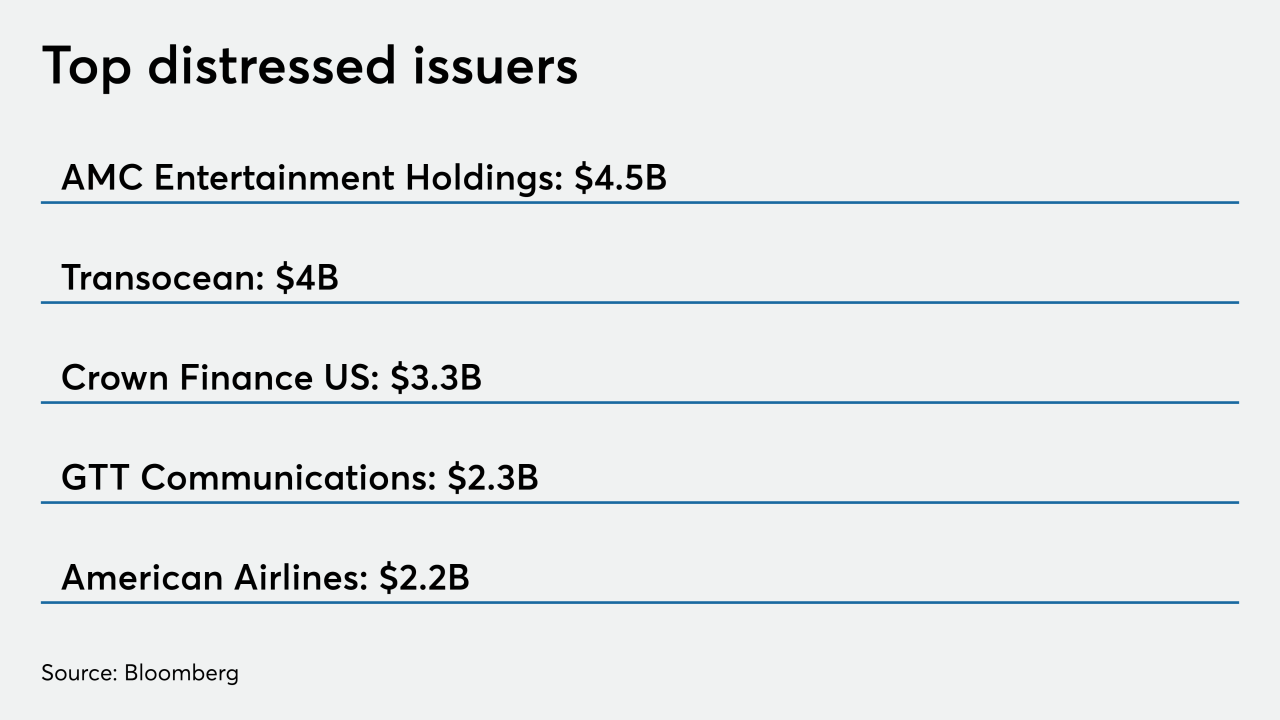

Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies - if that.

October 26