With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

Borrowers will likely have to put more assets on the line to get forbearance extensions.

But the 30-year fixed remains below 3%, which should continue to support increased demand.

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

The $500 million OneMain Financial Issuance Trust 2020-2 has triple-A senior-note ratings from three agencies, even as the economic upheaval of the coronavirus pandemic has prompted particular concerns about the risks in the lender’s key market of unsecured, subprime consumer loans.

San Francisco-based Theorem is marketing its first-ever securitization of online, unsecured consumer loans culled from the LendingClub origination platform using machine-learning technology.

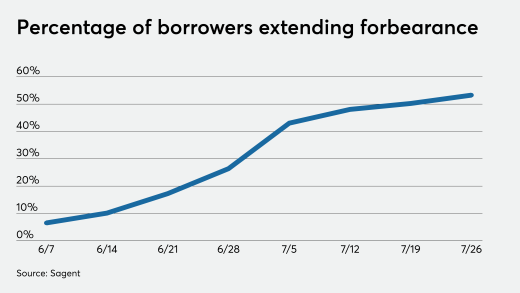

Though overall forbearance share is down, the number of extensions is rising as coronavirus hardship filings surpass the 90-day mark that delineates the end of traditional forbearance plans.

-

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

August 12 -

The $500 million OneMain Financial Issuance Trust 2020-2 has triple-A senior-note ratings from three agencies, even as the economic upheaval of the coronavirus pandemic has prompted particular concerns about the risks in the lender’s key market of unsecured, subprime consumer loans.

August 12 -

San Francisco-based Theorem is marketing its first-ever securitization of online, unsecured consumer loans culled from the LendingClub origination platform using machine-learning technology.

August 10