-

Large and mega investors accounted for 5.8% of all single family-home purchases in December, up from 4.8% at the same time last year, according to Cotality.

February 17 -

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

More than two-thirds of the counties most at risk of a housing downturn were concentrated in five states, according to a new report from Attom.

March 7 -

The latest plans include details on promoting housing development in underserved areas and increasing secondary market access to rural institutions.

November 27 -

Affordability improved for a fourth straight month, but questions remain about whether recent trends will bring a significant number of buyers into the housing market.

September 26 -

Moderating price growth and higher wages are leading to affordability relief, according to the Mortgage Bankers Association.

July 25 -

Prices in several cities came in more than 20% above what would be considered a sustainable level when compared to local economic factors, according to the rating agency's report.

March 1 -

With a scarcity of listings driving high home prices, both repeat and new purchasers are putting the most money down in decades, the report found.

November 15 -

Home purchasers had to come up with 0.9% more in April versus what they would have paid in March and 11.8% higher on a year-over-year basis, the Mortgage Bankers Association said.

May 25 -

Fannie Mae researchers found housing costs decelerating for the fourth straight quarter, but limited inventory may be driving hopeful buyers to look for opportunities in the new-construction market.

April 18 -

Buyer affordability has decreased by almost 22% in the past year, according to the Mortgage Bankers Association.

February 23 -

Quarterly numbers also show the smallest gain in appreciation since 2011, with values decreasing on an unadjusted basis, according to Fannie Mae.

October 17 -

Consumer demands for lower density and more affordable prices fueled a larger share of construction outside urban cores, but recent trends have led to slowdowns across the board.

September 6 -

At the same time, homes bought with FHA-backed loans accounted for the smallest share since 2007, according to an Attom sales report.

July 29 -

The slowdown in new single-family construction is one of several headwinds homebuilders find themselves facing this summer.

July 15 -

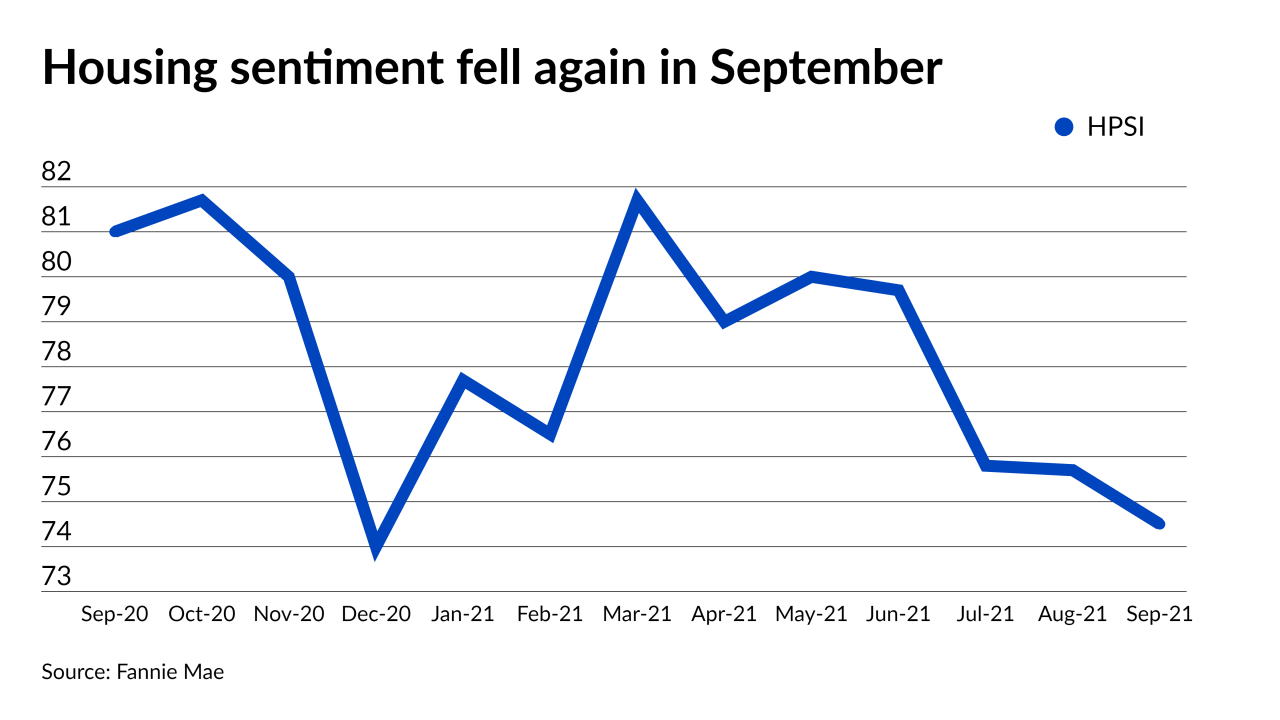

A larger share felt it was a bad time for both buying and selling, but a growing number expect price growth to slow.

May 9 -

Suburban pushback against a proposal that would have loosened regulations of new units in New York State led to its removal from the state budget.

April 11 -

While the median income rose 1% over the last year, the median price of a home rose a staggering 25%, according to the the Federal Reserve Bank of Atlanta.

March 27 -

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7