-

Quarterly numbers also show the smallest gain in appreciation since 2011, with values decreasing on an unadjusted basis, according to Fannie Mae.

October 17 -

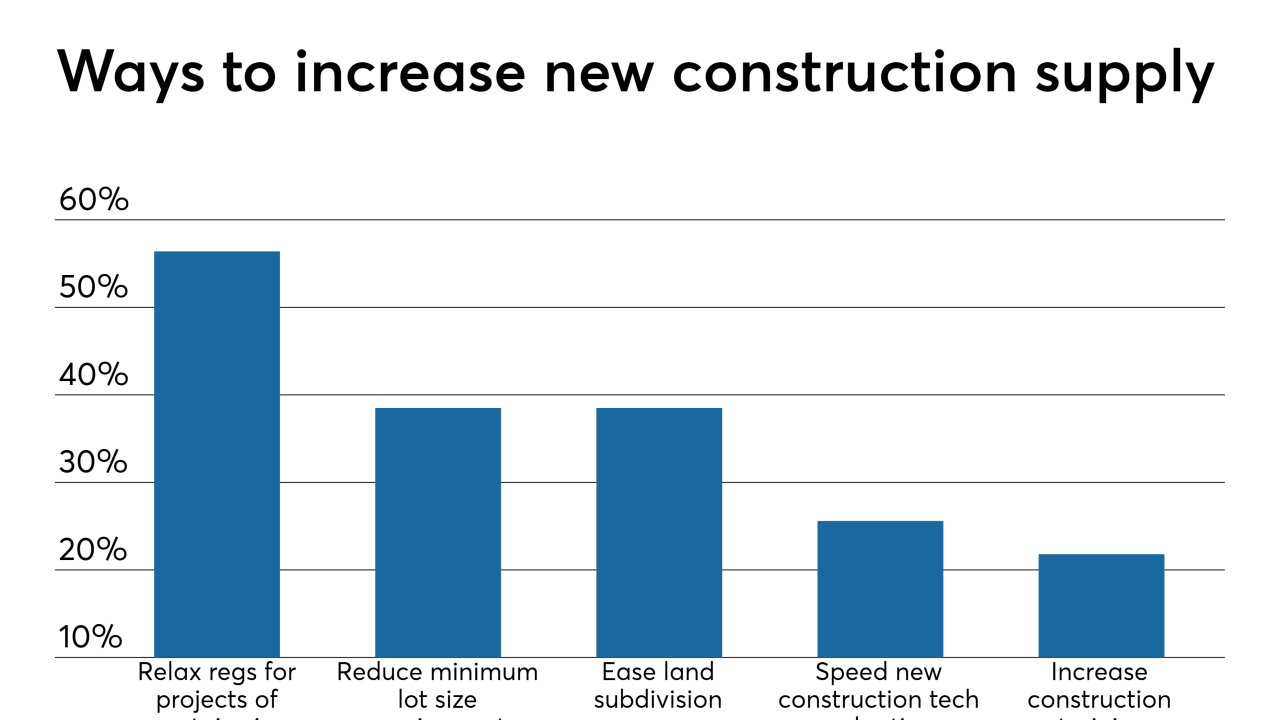

Consumer demands for lower density and more affordable prices fueled a larger share of construction outside urban cores, but recent trends have led to slowdowns across the board.

September 6 -

At the same time, homes bought with FHA-backed loans accounted for the smallest share since 2007, according to an Attom sales report.

July 29 -

The slowdown in new single-family construction is one of several headwinds homebuilders find themselves facing this summer.

July 15 -

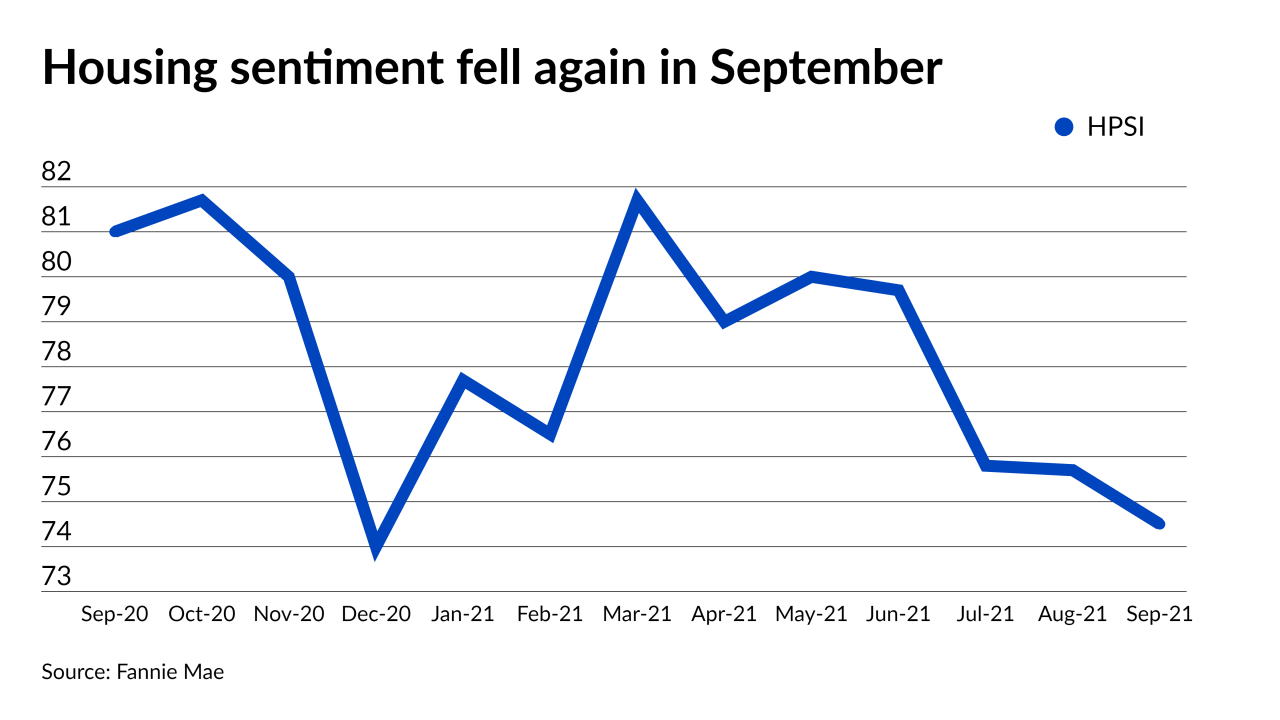

A larger share felt it was a bad time for both buying and selling, but a growing number expect price growth to slow.

May 9 -

Suburban pushback against a proposal that would have loosened regulations of new units in New York State led to its removal from the state budget.

April 11 -

While the median income rose 1% over the last year, the median price of a home rose a staggering 25%, according to the the Federal Reserve Bank of Atlanta.

March 27 -

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

August 12 -

The FHFA’s proposal is intended to strengthen Fannie Mae and Freddie Mac, but many experts warn that it could boost guarantee fees for lenders that they say may be passed on to borrowers.

June 8 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22