-

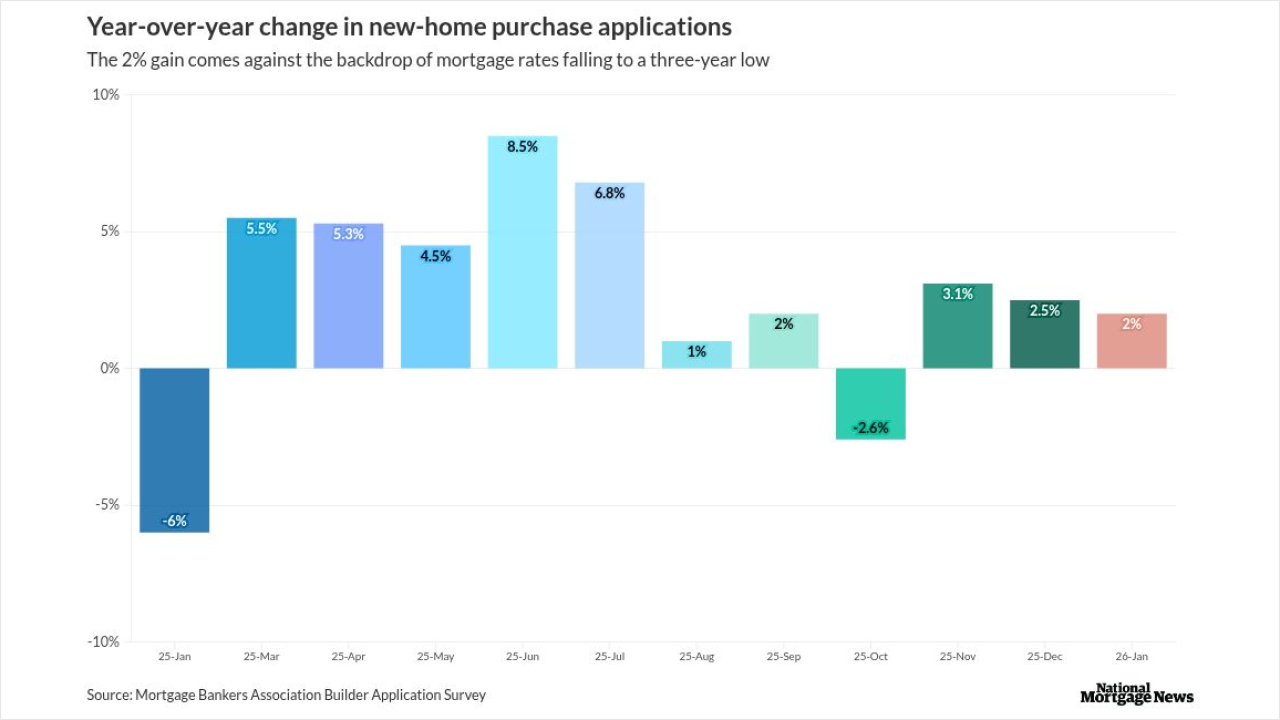

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

Many details have yet to be determined, including the role that federally-backed mortgages should play.

February 3 -

President Trump said big homebuilders are sitting on a record 2 million empty lots, and asked Fannie Mae and Freddie Mac to help restore the American Dream.

October 6 -

President Donald Trump will sign an executive order on Thursday imposing new tariff rates on trading partners that take effect Friday, the White House said.

July 31 -

A growing supply of unsold inventory applied downward pressure on prices, offering home buyers some relief, the Mortgage Bankers Association said.

May 15 -

American lumber producers have alleged that the Canadian lumber system amounts to a subsidy — a charge Canadians deny — and the countries have fought over tariffs on those products for decades.

March 7 -

Some mortgage stakeholders say Trump's tariffs would make interest rates rise and housing costs shoot up.

February 4 -

The manufactured home loan lender, a unit of Berkshire Hathaway subsidiary Clayton Homes, was accused of ignoring red flags that sent many borrowers into bankruptcy, default and ultimately out of their homes.

January 6 -

While the lock-in effect on existing supply has helped drive consumer interest in new construction, first-time buyers have been taking a greater share of that inventory.

September 23 -

Lending activity among builders surged over 22% annually in December, but the growing share of FHA-backed borrowing in the segment took a step back for the first time in four months, the Mortgage Bankers Association said.

January 18 -

The transactions grew between second and third quarter, with the new-home market seeing one of its largest surges in cash-buying in 13 years.

October 27 -

Decreased availability of bank capital for new commercial construction helped slow activity from the previous nine quarters, according to a new report.

September 8 -

The May uptick in nonbank housing-finance payrolls came almost entirely from lender hiring as loan broker numbers plateaued and construction demand persisted.

July 7 -

Construction activity in smaller cities also saw a significant annual decline, according to the National Association of Home Builders.

June 6 -

The Mortgage Bankers Association sees the likelihood of a rise in sales activity later this year based on recent construction trends, in a turnaround from the 2022 market.

May 19 -

Fannie Mae researchers found housing costs decelerating for the fourth straight quarter, but limited inventory may be driving hopeful buyers to look for opportunities in the new-construction market.

April 18 -

The CFPB is requesting input on adding specifications that are intended to alleviate TRID compliance concerns on construction-to-permanent single-close loans and those requiring separate construction and home loan closings.

March 6 -

Kindred Home Loans will serve buyers of properties in Dallas and San Antonio markets.

December 27 -

The decline in loan activity and softening prices also helped drive down builder sentiment for the 11th month in a row.

November 17 -

In a week where homebuilding stocks were faced with surging U.S. Treasury yields and data showing weakening demand for homes, one analyst is throwing in the towel on the sector.

October 23