-

While the lock-in effect on existing supply has helped drive consumer interest in new construction, first-time buyers have been taking a greater share of that inventory.

September 23 -

The CFPB is requesting input on adding specifications that are intended to alleviate TRID compliance concerns on construction-to-permanent single-close loans and those requiring separate construction and home loan closings.

March 6 -

The head of the Federal Housing Administration said Congress should consider whether to continue allowing the loan floor and ceiling to remain tied to changes in the conforming mortgage limit.

December 2 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 27

-

The proposed reforms of Fannie Mae and Freddie Mac have gotten all the attention, but the administration also wants to scale back the Federal Housing Administration, expand its capital cushion and adopt risk-based pricing. Some of the ideas have former agency officials concerned.

September 19 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

The gap between supply and demand in the housing market is contributing to affordability constraints that are likely to limit homeownership long-term, according to Freddie Mac.

December 6 -

In its latest effort to reach first time home buyers, Freddie Mac is launching a new 3% down payment program that casts aside a number of restrictions in its existing low down payment offerings.

May 2 -

The recently enacted tax reform bill is likely to encourage more consumers to rent instead of buy and tamp down the rapid rise in home prices.

January 4 -

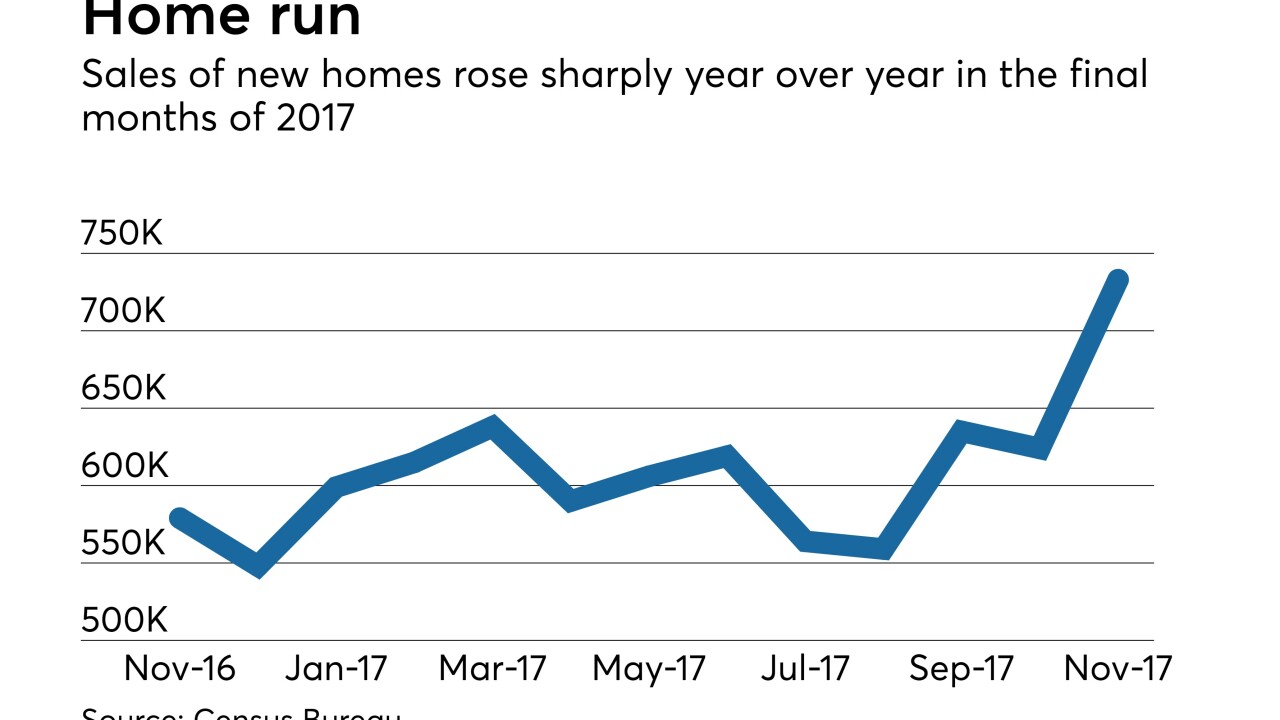

Home values grew during 2017 at their fastest pace in four years and the same supply and demand dynamics behind that increase remain in place for 2018.

December 28 -

Rather than working with large-scale investors, Freddie Mac said it will focus on assisting community organizations and local institutions to fund single-family properties for renters with special needs.

July 24