Monthly mortgage payments for home purchasers rose again in April, as they are continuing to be affected by

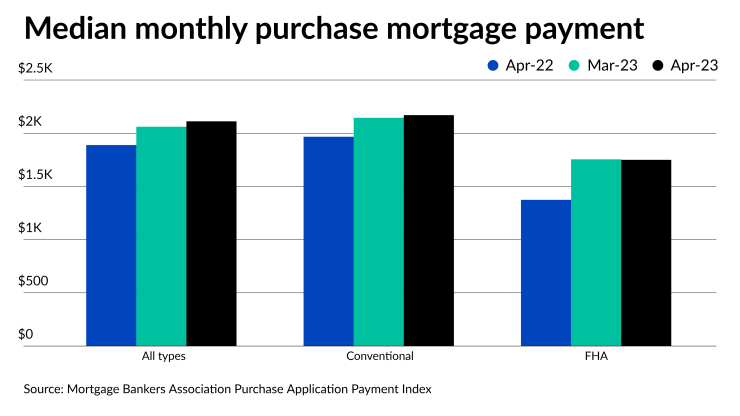

The Purchase Application Payment Index found the median payment buyers applied for rose by 0.9% to $2,112 from $2,093 in March. For April 2022, the PAPI

This measurement

"Homebuyer affordability eroded further in April, with both the typical borrower monthly payment and median purchase amount rising due to higher rates and home prices," said Edward Seiler, the MBA's associate vice president, housing economics, and the executive director of the Research Institute for Housing America, in a press release.

When measured as an index value, April's PAPI of 172.3 was up 0.5% from March's 171.5 and 5.3% over 163.6 a year ago. A higher index value means affordability has declined. The index increased for Black households to 176.6 from 175.8; Hispanic households to 161 from 160.2; and white households to 173 from 172.2.

For conventional loans, a category that includes both conforming and jumbo products, the national median mortgage payment was $2,170, up from $2,145 in March and from $1,967 in April 2022.

On the other hand, Federal Housing Administration applicants actually found the median payment decreased on a month-to-month basis, $1,750 in April, down from $1,755 in March. But it was up from $1,374 in April 2022.

Also moving down in April from March was the Builder PAPI, to $2,445 from $2,508;