Credit cards

Credit cards

-

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

January 31 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

After rising between 2016 and 2018, the card issuer's charge-off rates are now steady. The trend reflects both the impact of tighter underwriting standards and the continued resilience of U.S. consumers.

July 19 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

The upstart lenders have been chipping away at credit cards’ consumer-lending dominance by offering fixed-rate loans with predictable repayment plans. Now the card giants are fighting back.

March 8 -

The foray into digital consumer lending follows a similar move by rival Citigroup.

February 26 -

The move, reported by The Wall Street Journal, could be part of a deeper foray into cobranded cards by Goldman, which has been expanding into consumer finance through its Marcus unit.

February 21 -

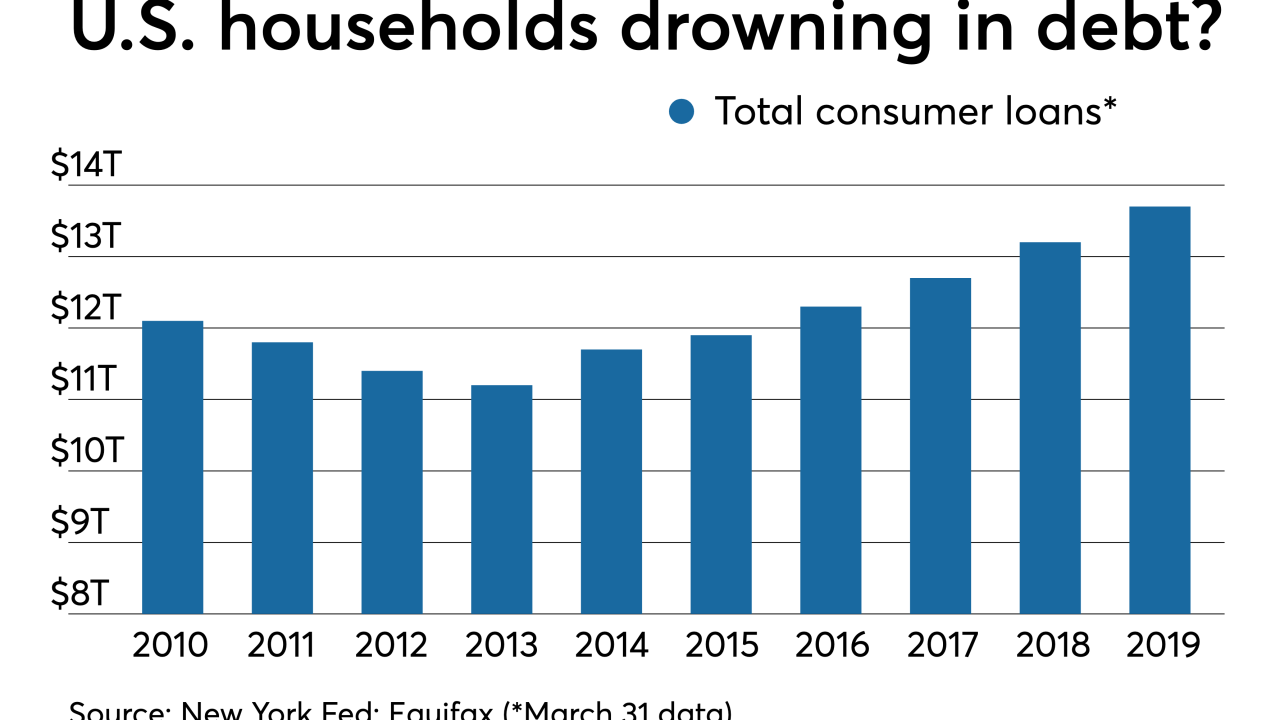

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

In selling its Walmart credit card portfolio to Capital One and extending a partnership with Sam’s Club that appeared to be in peril, Synchrony Financial avoids an expensive legal battle with the world’s largest retailer.

January 23 -

As part of the agreement with HSN, Synchrony has also extended its partnerships with HSN affiliates QVC and the e-commerce site Zulily.

December 20 -

Margaret Keane discussed Synchrony's investments in technology, including how the card issuer plans to use customer data to help retailers create targeted ads, during an appearance Tuesday in New York,

October 30 -

Citigroup spent years reeling in customers with promotional rates, many of which have expired or soon will. The bank thinks it can keep a large number of those customers and make more money off of them.

October 12