Credit card delinquency rates hit a seven-year high in the first quarter largely because many borrowers in their 20s are struggling to keep up with their minimum payments, according to a new report from the Federal Reserve Bank of New York.

In its quarterly report on household debt and credit trends released Tuesday, the New York Fed said that 5.04% of credit card loan balances were at least 90 days past due at March 31, up from 4.72% in the same quarter last year. It marked the first time since 2012 that 90-day delinquencies topped 5%.

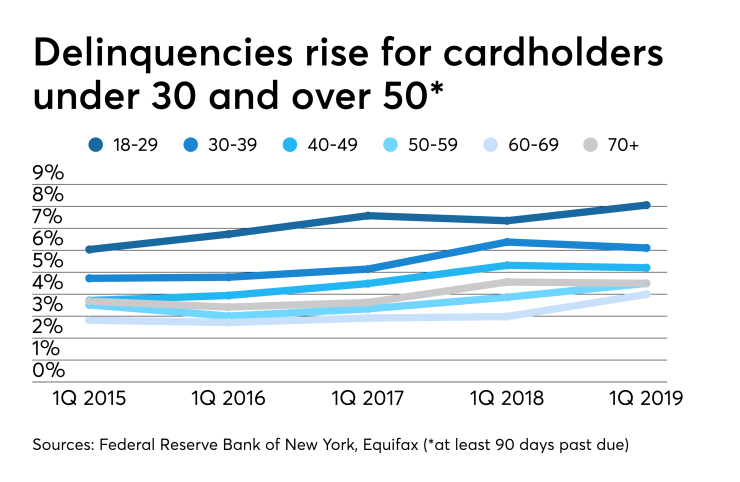

For cardholders ages 18 to 29, 90-day delinquencies climbed to 8.05%, up from 7.34% a year earlier and 6.03% in the first quarter of 2015.

The New York Fed attributed the spike in delinquencies among this demographic to the fact that more than half of young adults ages 20 to 29 had credit cards in the first quarter, compared with a low of 41% in 2012. Credit card accounts among younger borrowers declined sharply starting in 2009, as federal regulations limited excessive marketing to the very youngest consumers, but underwriting standards have loosened since then, New York Fed economists said in a blog post that accompanied the data.

“The rate at which credit card balances become delinquent has been rising, and that has coincided with an increase in younger borrowers entering the credit card market,” Andrew Haughwout, senior vice president at the New York Fed and one of the authors of the blog post, said in a press release.

To be sure, delinquency rates on most consumer loans tend to be highest among younger borrowers. Consumers under 30 typically earn less than older consumers and are often still forming their financial habits.

The New York Fed also pointed out that delinquency rates remain well below historic highs and that worsening delinquency rates tend to be concentrated among borrowers with credit scores under 660. For borrowers ages 18 to 29, 90-day delinquencies peaked at nearly 14% in the third quarter of 2008. For all borrowers, delinquencies peaked at nearly 11% in the fourth quarter of 2009.

Still, delinquency rates are trending up again, and not just for younger consumers. According to the report, seriously delinquent credit card balances have also been rising among consumers between the ages of 50 and 69. For borrowers ages 50 to 59, they climbed by 87 basis points year over year, to 4.49% at March 31. For those 60 to 69, 90-day delinquency rates increased by 99 basis points, to 3.99%.

The New York Fed did not speculate as to why delinquencies might be creeping up among older consumers. However, the agency did point to other research showing that older borrowers hold more debt, and more kinds of debt, than they did a decade ago. It could be that older Americans, especially those with lower income levels, are struggling to balance their financial obligations as they begin to age out of the workforce or take on increased medical expenses.

Total credit card balances stood at $850 billion in the first quarter of 2019, representing an increase of $33 billion, or 3.6%, from the same quarter last year.

Overall household debt totaled $13.7 trillion in the first quarter, or 3.5% higher than it was a year earlier. Household debt has now risen for 19 consecutive quarters. Mortgage debt still represented the greatest share of household debt, rising 3.4% to $9.24 trillion nationwide.

Student debt totaled nearly $1.5 trillion in the first quarter, or 5.6% higher than a year ago, and represented the second-largest category of debt.

Auto debt rose 4% to $1.28 trillion. Balances on home equity lines of credit continued to decline, totaling $410 billion in the first quarter, something the New York Fed attributes to waning popularity of that loan product.

The agency also found delinquency rates on student loans worsening, while delinquencies on auto loans remained stable from the year-ago period and delinquencies on mortgage loans improved.

The New York Fed also found that over the last six months, the number of credit inquiries to Equifax declined to 137 million. That’s the lowest level since it began tracking that data in 1999. However, the agency said that may not indicate a declining appetite for credit. Instead, it could be that TransUnion and Experian, which the agency does not track, are receiving more credit inquiries than Equifax.