Sen. Elizabeth Warren warned Monday that the U.S. economy is at risk of a recession, largely due to high levels of debt among both consumers and businesses.

“Warning lights are flashing. Whether it’s this year or next year, the odds of another economic downturn are high — and growing,” Warren wrote in a Medium post. “Congress and regulators should act immediately to tamp down these threats before it’s too late.”

Warren said that her warnings in advance of the last recession were ignored by Federal Reserve Chairman Alan Greenspan and others who had the power to head off the financial crisis. At the time, she was a Harvard law professor who was known as an expert in bankruptcy.

Now Warren is a Democratic presidential candidate who wants to cancel more than 95% of U.S. student loan debt, provide free child care for millions of children from lower-income families, and make public colleges free to attend.

She made the case Monday that those policies would help stabilize what she called the “shaky foundation” of the U.S. economy by reducing household debt.

Warren noted that student loan debt has more than doubled since the financial crisis,

“Families may be able to afford these debt payments now, but an increase in interest rates or a slowdown in income could plunge families over a cliff,” Warren wrote.

Her warnings about

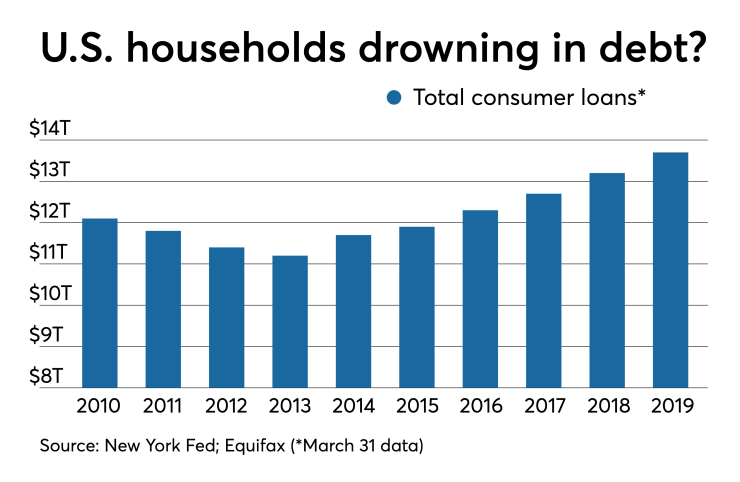

Total household debt climbed rapidly from $8.29 trillion in the first quarter of 2004 to $12.68 trillion in the third quarter of 2008, according to data from the New York Fed. It then fell as low as $11.15 trillion in 2013, but has since climbed to a new record high of $13.67 trillion.

Some observers have downplayed concerns about consumer debt levels by noting that wages have also been rising. Household debt service payments as a percentage of disposable income remain significantly lower than they were between 2000 and 2008.

There's also little danger of the Fed raising interest rates in the immediate future, as the central bank has signaled that it could soon begin lowering rates in response to signs that the economy is weakening.

Warren also pointed to the manufacturing sector, which shrunk in the first two quarters of this year, and increases in corporate debt, as warning signs about the U.S. economy.

She urged regulators to more aggressively monitor leveraged corporate lending, a rapidly growing market that she said poses a serious risk to the economy.

“Leveraged lending — lending to companies that are already seriously in debt — has jumped by 40% since Trump took office,” she wrote.

“These high-risk loans now make up a quarter of all American business loans and they look a lot like the pre-2008 subprime mortgages: poorly underwritten loans with minimal protections that are then packaged and sold to investors,” Warren added.

Warren specifically called on the Financial Stability Oversight Council, a regulatory body Congress created in the wake of the last financial crisis, to meet and assess the risks posed by leveraged lending.

“The risks of leveraged lending are exactly the kind of thing FSOC is supposed to monitor, but the Trump-era FSOC is falling down on the job,” she wrote.

During the Trump administration, critics have said that

Warren’s call for the FSOC to examine leveraged loans could give the council a new mission, although it’s unlikely that Treasury Secretary Mnuchin, who chairs the FSOC, would take Warren’s advice.

The Massachusetts senator’s comments on leveraged loans echo other recent statements by lawmakers and officials, including former

Many bankers, analysts and regulators have argued that the concerns about leveraged loans are overblown, and have stressed that banks have limited exposure to the sector. Fed Chair Jerome Powell said last month that

In February, analysts at Moody’s Investors Service said banks’

Banks do have a growing exposure to leveraged loans through an indirect channel. Loans made to nondepository financial institutions was the