-

The class action case, first brought up in 2020, accused Lakeview Loan Servicing and LoanCare of violating the Texas Debt Collection Act by charging "junk" fees.

October 2 -

Decreased availability of bank capital for new commercial construction helped slow activity from the previous nine quarters, according to a new report.

September 8 -

Canada's banking regulator is proposing to make it more costly for lenders to accommodate mortgage borrowers who stretch out their loans in an effort to limit housing-market risks in the financial system.

July 11 -

Prime Minister Justin Trudeau's government is considering winding down the Canada Mortgage Bond program in a bid to reduce borrowing costs.

July 6 -

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

March 4 -

With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

December 21 -

Canada’s national pension fund struck its first partnership to build and rent out single-family homes in the U.S., joining a rush to capitalize on a housing shortage.

December 8 -

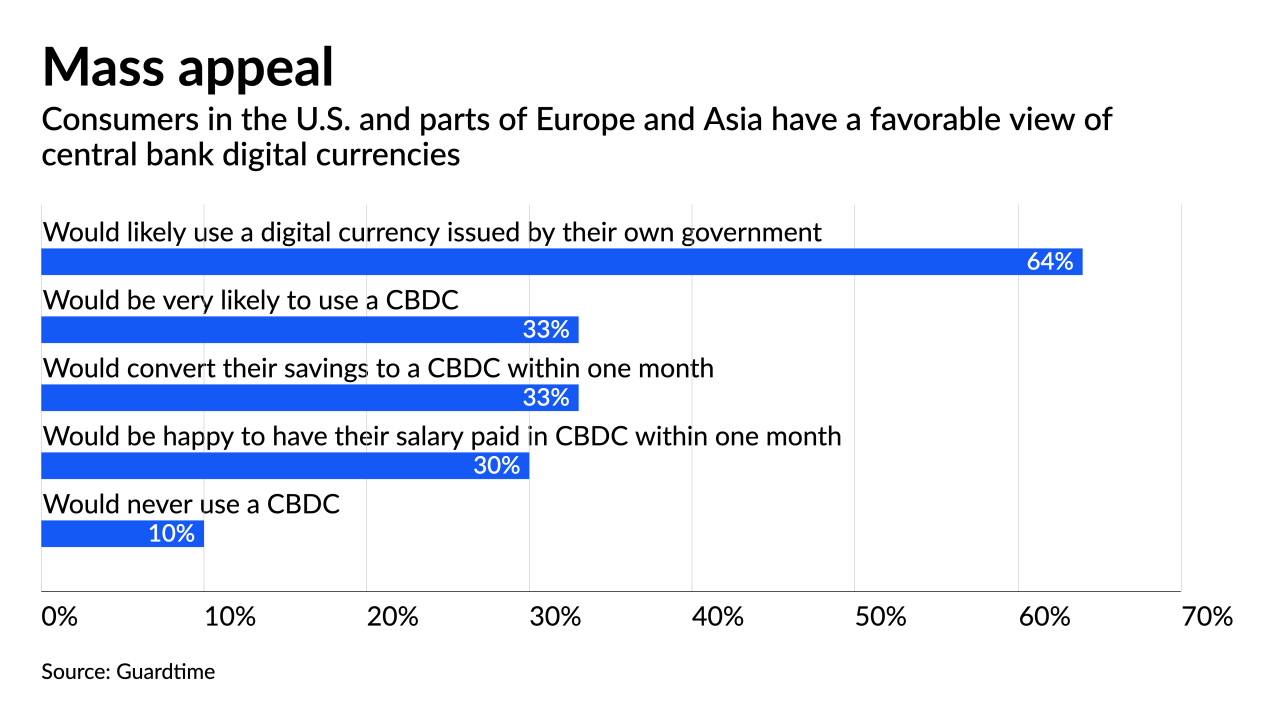

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

Goeasy would join the likes of Canadian non-prime lender Fairstone Financial Inc., which sold its inaugural ABS transaction in 2019. Also that year, Home Capital Group Inc. priced the first deal pooling non-prime Canadian home loans since 2007.

May 5 -

The 2021 deal tally is split between $37 billion in new-issue transactions along with $68 billion in refis/resets, according to S&P Global Ratings.

March 29 - LIBOR

Concerned that some troublesome financial contracts won’t be able to switch to replacement benchmarks, the Financial Conduct Authority plans to publish a “synthetic” London interbank offered rate.

March 26 -

Two banking bills signed by Gov. J.B. Pritzker carry implications for payday lenders, auto title lenders, credit unions and nonbank mortgage lenders. Pritzker, a Democrat, said the bills will address racial-equity gaps in the state.

March 23 -

Just over 12 billion euros ($14.6 billion) of new issue, refi and reset paper has priced so far this year, surpassing a previous high of 7.3 billion euros in the first two months of 2018.

February 24 -

The Japanese lender will back $526 million in U.S. dollar-denominated notes with receivables of domestic new- and used-car loans from domestic borrowers.

February 10 -

The receivables will flow from payments on UK monoline credit-card accounts for nonprime borrowers.

January 25 -

A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York’s Upper West Side and Harlem filed for bankruptcy.

December 30 -

HomeEquity will sell an as-yet undetermined volume of notes to finance forthcoming originations by the bank sponsored by Birch Hill Equity Partners Management.

December 8 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The European Union's first social bond sale, totaling 17 billion euros, was 14 times oversubscribed, meaning the EU could have sold 200 billion euros worth of bonds. That indicates a market that’s structurally underserved.

October 22