JPMorgan Chase CEO Jamie Dimon says the partisan bickering over coronavirus relief aid is harming households and businesses and jeopardizing the chances of an economic recovery.

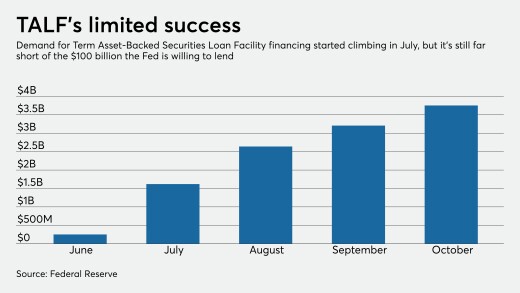

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

Mortgage rates moved off of their all-time low this week as a result of reports that Pfizer's coronavirus vaccine was potentially 90% effective, according to Freddie Mac.

Brookfield's Capital Automotive is marketing a new series of bonds secured by revenues from property sale-leaseback agreements with large auto dealer groups.

Signs of weakness are showing in commercial real estate where property values have begun falling. The report also said that hedge fund leverage has remained elevated and that life insurers are reaching debt levels not seen since the 2008 financial crisis

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

With a Democrat set to take the White House in January, the agenda for agencies like the CFPB could undergo a rapid transformation, housing finance reform could be turned on its head and progressive banking ideas that were unthinkable over the past four years could gain traction.

-

JPMorgan Chase CEO Jamie Dimon says the partisan bickering over coronavirus relief aid is harming households and businesses and jeopardizing the chances of an economic recovery.

November 18 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Mortgage rates moved off of their all-time low this week as a result of reports that Pfizer's coronavirus vaccine was potentially 90% effective, according to Freddie Mac.

November 12 -

Brookfield's Capital Automotive is marketing a new series of bonds secured by revenues from property sale-leaseback agreements with large auto dealer groups.

November 10 -

Signs of weakness are showing in commercial real estate where property values have begun falling. The report also said that hedge fund leverage has remained elevated and that life insurers are reaching debt levels not seen since the 2008 financial crisis

November 10 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

November 9