ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

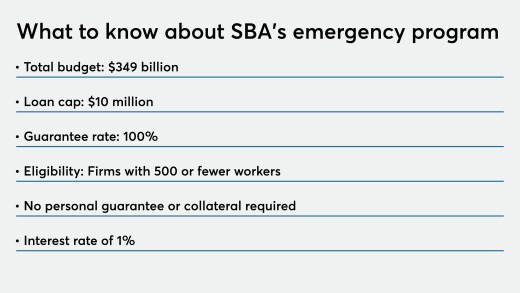

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

The change — effective immediately — will reduce capital demands by about 2% overall, the Fed estimated, and will be open for a 45-day comment period.

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

Bank of America said it has agreed to allow 50,000 mortgage customers to defer payments for three months because they've lost income as a result of the pandemic.

-

ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

April 3 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

The change — effective immediately — will reduce capital demands by about 2% overall, the Fed estimated, and will be open for a 45-day comment period.

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1 -

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

April 1