-

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

February 24 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

January 14 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

Fed Chair Jerome Powell, speaking at a press conference after the December FOMC meeting, said the central bank is holding interest rates steady until it gets more clarity on the economy.

December 10 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

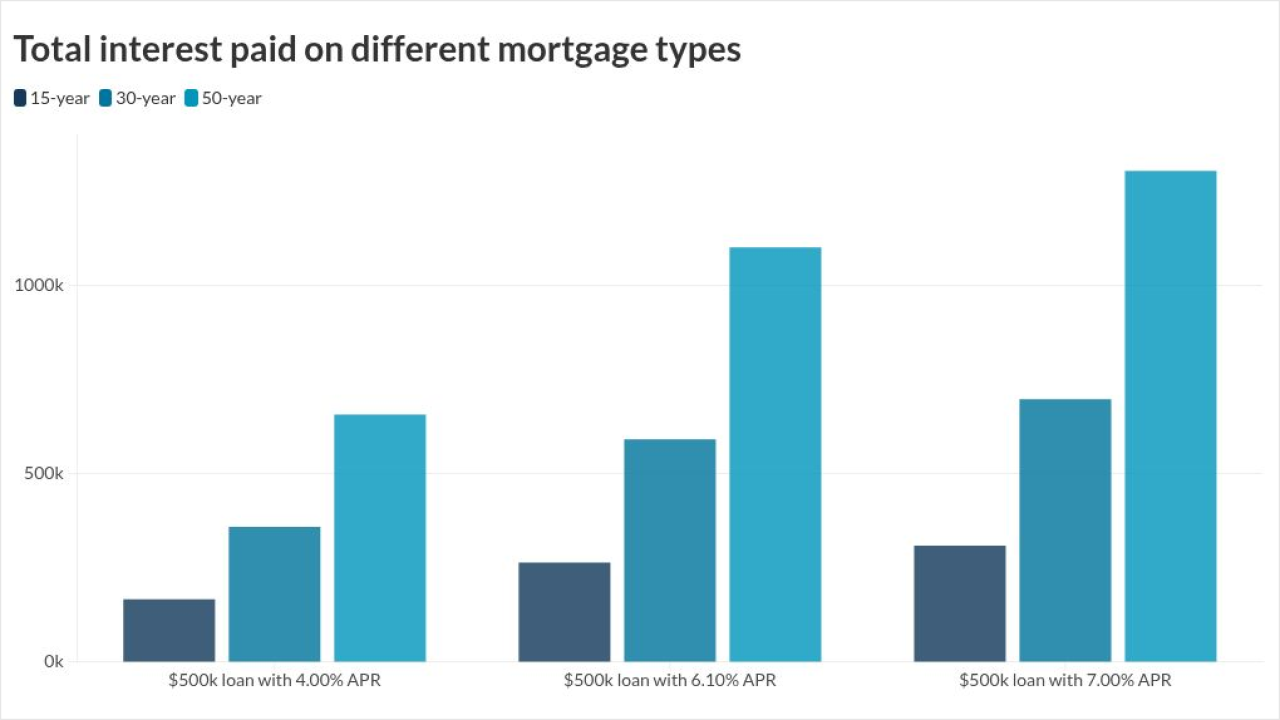

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

The Federal Open Market Committee is expected to announce guidance on the end of its quantitative tightening program later Wednesday. As that process draws to a close, experts are questioning when and how the central bank should use its balance sheet to smooth economic stress in the future.

October 29 -

Federal Reserve Governor Stephan Miran said the economic standoff with China could increase market volatility, further necessitating the central bank to move its policy stance to neutral.

October 15 -

Federal Reserve Gov. Michael Barr said in a speech Thursday that he fears the gradual pace of price increases from tariffs being passed on to consumers may prolong the one-time inflationary effect of the tariffs to the point where it affects consumers' inflation expectations.

October 9 -

Federal Reserve Chair Jerome Powell said in a speech Tuesday that the central bank's policy stance is "modestly restrictive," a stance that will give the central bank flexibility to react to an uncertain economic future.

September 23 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Tuesday that steeper interest rate cuts should be on the table if the labor market continues to show signs of decline.

September 23 -

The Federal Open Market Committee's decision to reduce interest rates for the first time in nine months lifted bank stocks Wednesday. The 25-basis-point reduction could lead to net interest income headwinds now, but loan growth later, analysts said.

September 17 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said she foresees three interest rate cuts for this year, a view bolstered by the latest employment data.

August 11 -

Officials are balancing food and retail payroll tax and wage inflation risks against mounting jobs losses and a "subdued" economy that could dampen future price pressures.

August 7 -

President Trump and Senate Banking Committee Chair Tim Scott, R-S.C., visited the Federal Reserve Board headquarters Thursday afternoon to inspect ongoing renovations whose cost overruns have heightened scrutiny of Fed chair Jerome Powell.

July 24