The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

The agency said it is aligning policies for Fannie Mae- and Freddie Mac-backed loans in forbearance so that servicers are only responsible for advancing four months of missed payments.

The lender behind the credit cards for Gap, J.C. Penney and other retailers took a large provision for loan losses and abandoned full-year earnings guidance as the nationwide shutdowns tied to the coronavirus pandemic have led to a sharp decline in spending on its cards.

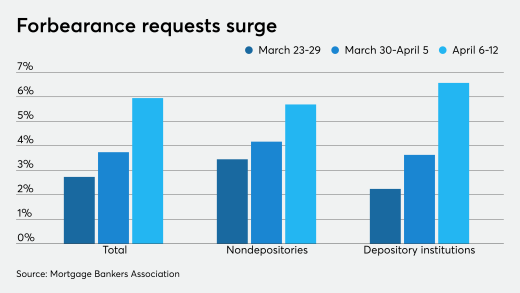

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

Federal backing for firms facing a deluge of missed mortgage payments is still on the table despite recent comments by an official who questioned the need to help the industry.

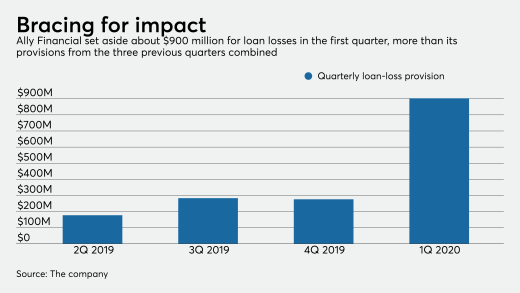

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

The new-issue pipeline of prime auto loans remains open despite the gloomy forecasts for pandemic-related stresses on auto sales and consumer unemployment levels.

-

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

April 21 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The agency said it is aligning policies for Fannie Mae- and Freddie Mac-backed loans in forbearance so that servicers are only responsible for advancing four months of missed payments.

April 21 -

The lender behind the credit cards for Gap, J.C. Penney and other retailers took a large provision for loan losses and abandoned full-year earnings guidance as the nationwide shutdowns tied to the coronavirus pandemic have led to a sharp decline in spending on its cards.

April 21 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

Federal backing for firms facing a deluge of missed mortgage payments is still on the table despite recent comments by an official who questioned the need to help the industry.

April 20 -

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

April 20