The Pennsylvania senator, who will chair the Banking Committee if Republicans hold their majority, agreed to modify an amendment restricting the Federal Reserve’s emergency powers that Democrats had criticized as too extreme.

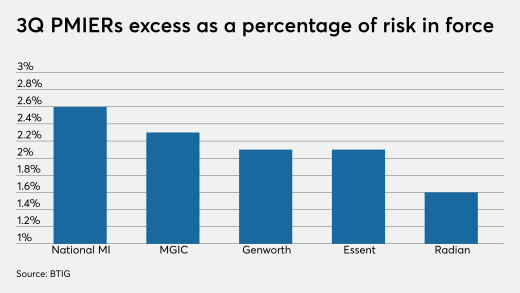

The company expects a good year ahead for mortgage insurers, assuming that rising employment, higher home prices and payment timing deferrals will help them to mitigate risk.

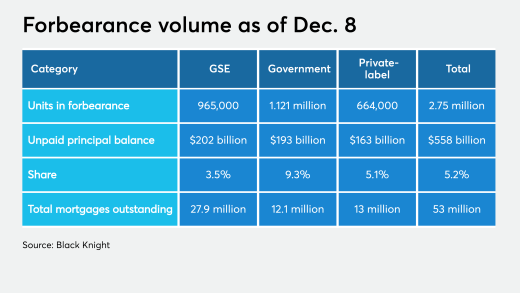

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

The Federal Reserve has already agreed to shut down emergency credit programs funded by the Coronavirus Aid, Relief and Economic Security Act, but Sen. Pat Toomey, R-Pa., and others want Congress to ensure the central bank cannot revive them.

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

-

The Pennsylvania senator, who will chair the Banking Committee if Republicans hold their majority, agreed to modify an amendment restricting the Federal Reserve’s emergency powers that Democrats had criticized as too extreme.

December 21 -

The company expects a good year ahead for mortgage insurers, assuming that rising employment, higher home prices and payment timing deferrals will help them to mitigate risk.

December 18 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The Federal Reserve has already agreed to shut down emergency credit programs funded by the Coronavirus Aid, Relief and Economic Security Act, but Sen. Pat Toomey, R-Pa., and others want Congress to ensure the central bank cannot revive them.

December 17 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11