Banks participating in the Main Street Lending Program were able to register for and offer credit to businesses last month, but the Federal Reserve said Monday it was set to make the effort fully operational.

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

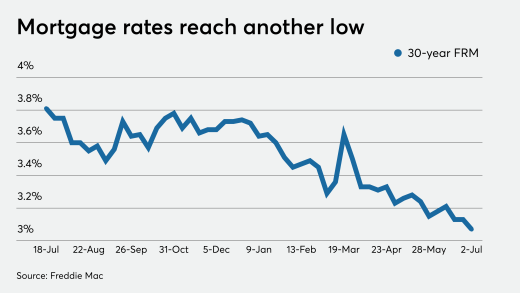

Mortgage rates reached their lowest level this week since Freddie Mac began its Primary Mortgage Market Survey in 1971, but they might not have yet gotten to their floor.

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

The collateral in the $338 million also includes a large subset of mortgages (45% of the pool) that are considered "dirty current" loans with recent delinquent status.

The U.S. economy can escape another decadelong slog back to health if strong public measures or a vaccine curb virus surges, Federal Reserve Bank of San Francisco President Mary Daly said.

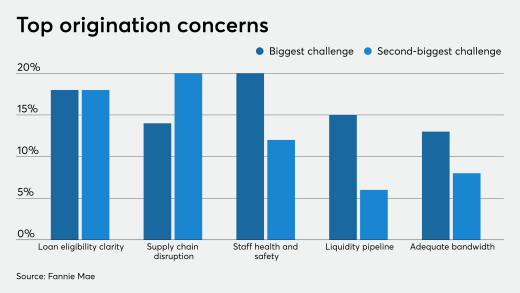

Lenders and servicers' biggest pandemic challenges revolve around clarity for loan eligibility and understanding options for their borrowers once the forbearance period ends.

Chris Dodd and Barney Frank said the legislation — nearing its 10th anniversary — put banks in position to be a stabilizing force during the coronavirus crisis.

-

Banks participating in the Main Street Lending Program were able to register for and offer credit to businesses last month, but the Federal Reserve said Monday it was set to make the effort fully operational.

July 6 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

Mortgage rates reached their lowest level this week since Freddie Mac began its Primary Mortgage Market Survey in 1971, but they might not have yet gotten to their floor.

July 2 -

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

The collateral in the $338 million also includes a large subset of mortgages (45% of the pool) that are considered "dirty current" loans with recent delinquent status.

July 1 -

The U.S. economy can escape another decadelong slog back to health if strong public measures or a vaccine curb virus surges, Federal Reserve Bank of San Francisco President Mary Daly said.

July 1 -

Lenders and servicers' biggest pandemic challenges revolve around clarity for loan eligibility and understanding options for their borrowers once the forbearance period ends.

July 1