Technology

Technology

-

Technology shares in the S&P 500 Index fell as much as 2.9% led by Nvidia Corp. shares, which slumped 5.6% after reporting quarterly results after the close Wednesday.

February 26 -

Futures spreads linked to the Secured Overnight Financing Rate, which closely track expected Fed policy, are becoming deeply inverted — a sign that traders are starting to price a more prolonged central bank easing cycle.

February 25 -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

February 24 -

As finance chiefs feel the pressure to include AI in business models and work flows, the ABS industry is responding with leaner internal operations and reduced human errors.

February 19 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

It's the first time either S&P Global Ratings, Moody's or Fitch Ratings has handed out a triple A rating to a data center ABS deal, has assigned previous Compass offerings its highest rating.

February 12 -

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

February 6 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

Across US CMBS and ABS, JPMorgan projects annual data center securitization issuance could reach $30 billion to $40 billion in both 2026 and 2027.

February 2 -

Pre- and post-purchase, buy now/pay later loans from Affirm will be available on Fiserv-issued debit cards. Last year, Affirm and FIS inked a deal to bring Affirm's BNPL loans to FIS-issued debit cards.

January 26 -

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

Federal Reserve Vice Chair Philip Jefferson said that as interest rates have moved toward a more neutral level, "it makes sense" now to proceed with caution.

November 7 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

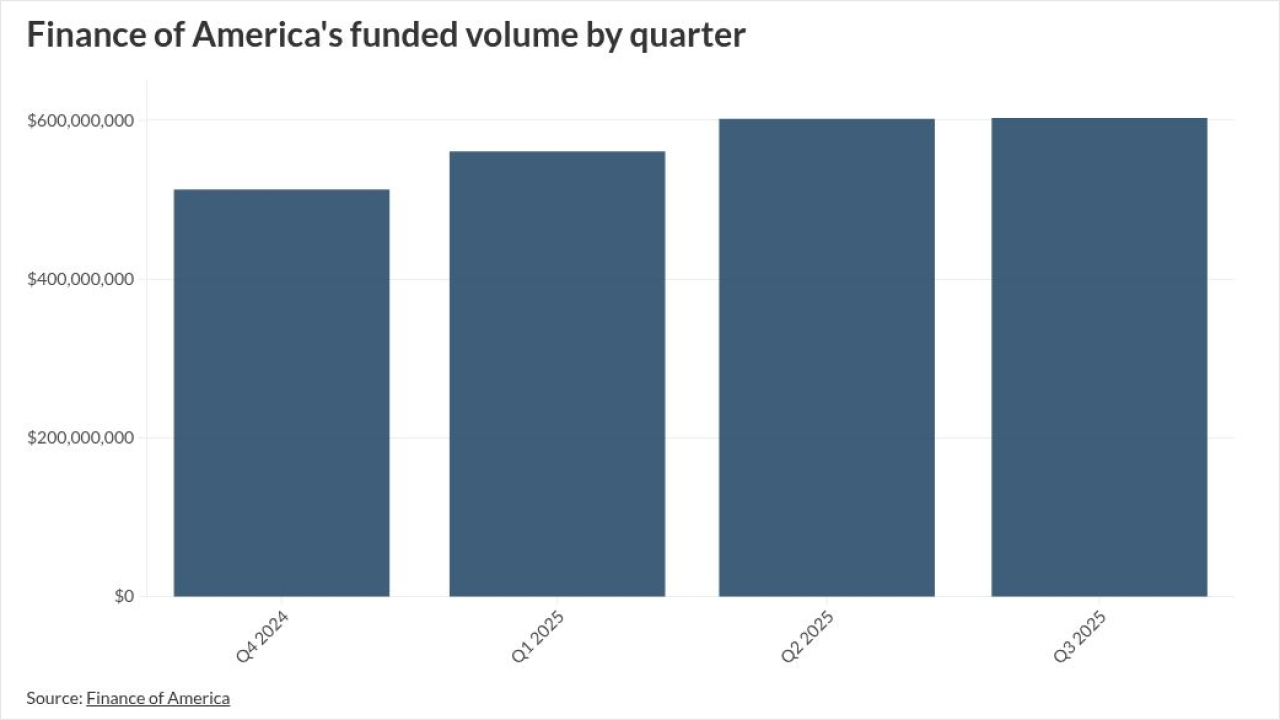

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

In terms of asset fundamentals, the high-quality tenant committed to a 15-year lease with maturity dates through various end dates in 2040. That includes 2.0% annual rent increases.

October 28 -

Switch has a large national network of data center properties, with more than 700 patents and patents pending for designs and operations in the space.

October 20