Credit cards

Credit cards

-

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

Since March, issuers have tightened their criteria for opening new accounts and closed millions of existing ones in hopes of avoiding waves of defaults.

May 29 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

April 23 -

Discover is the latest card lender to say it's reining in credit lines as the coronavirus pandemic leaves millions of Americans jobless and struggling to keep up on loans.

April 23 -

The lender behind the credit cards for Gap, J.C. Penney and other retailers took a large provision for loan losses and abandoned full-year earnings guidance as the nationwide shutdowns tied to the coronavirus pandemic have led to a sharp decline in spending on its cards.

April 21 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

The company once again lowered its outlook for quarterly revenue growth, saying the coronavirus pandemic has led to a sharp decline in cardholders’ overseas spending.

March 30 -

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

March 26 -

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

January 31 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14 -

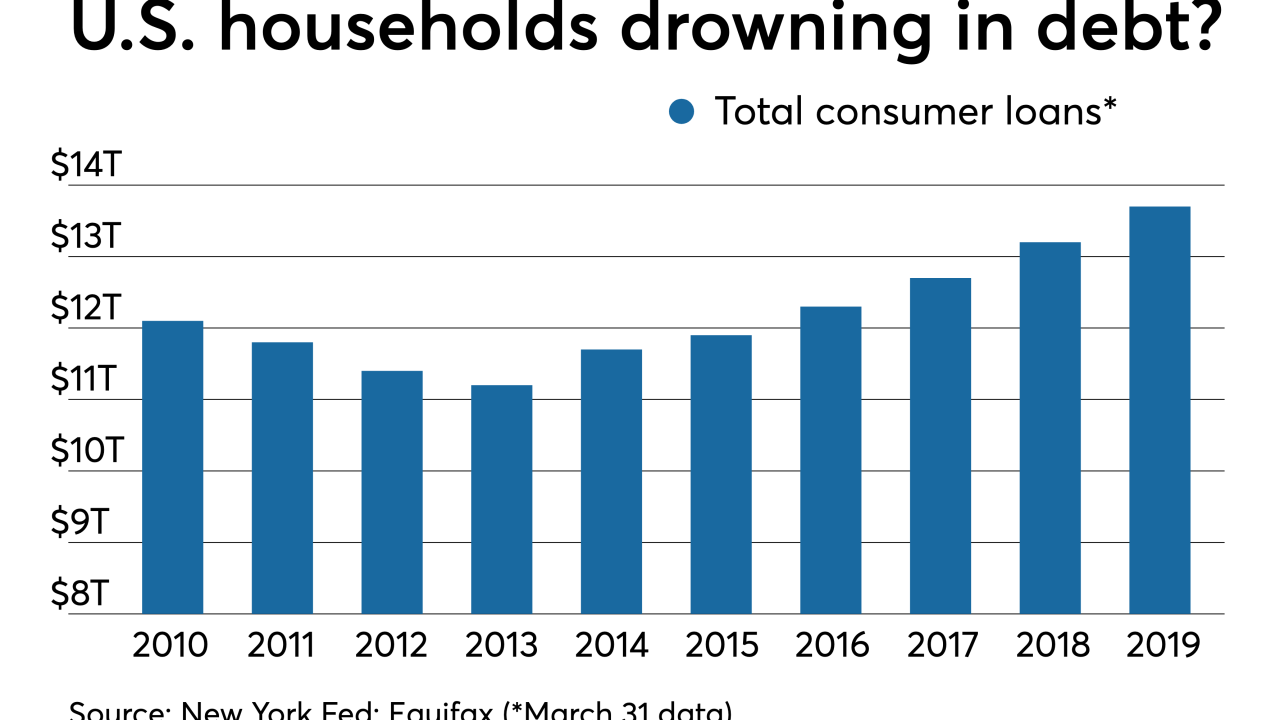

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

After rising between 2016 and 2018, the card issuer's charge-off rates are now steady. The trend reflects both the impact of tighter underwriting standards and the continued resilience of U.S. consumers.

July 19 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14