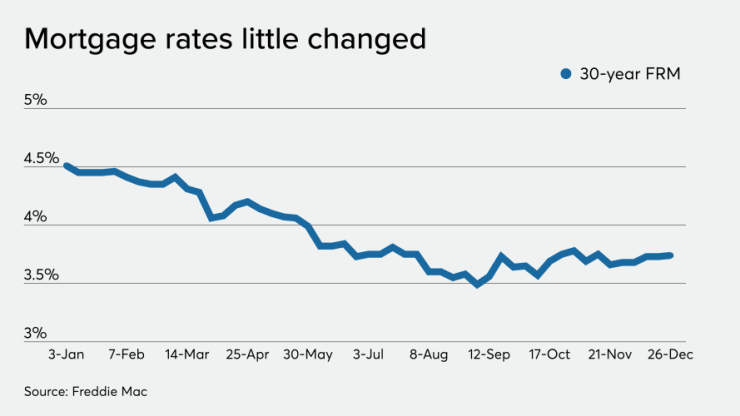

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

"The 30-year fixed-rate mortgage rate saw little change again this week and averaged just 3.9% during 2019, the fourth lowest annual average level since 1971 when Freddie Mac started its weekly survey," Sam Khater, Freddie Mac's chief economist, said in a press release.

"Heading into

The 30-year fixed-rate mortgage averaged 3.74% for the week ending Dec. 26, up just 1 basis point from

The 15-year fixed-rate mortgage averaged 3.19%, unchanged from last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.01%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.45% with an average 0.3 point, up from last week when it averaged 3.37%. A year ago at this time, the five-year adjustable-rate mortgage averaged 4%.

Rates are expected to remain steady at an average of 3.8% for the 30-year fixed loan through the end of 2021.

"A more accommodative monetary policy stance and robust labor market helped the U.S. housing market regain its footing in 2019," Khater added.