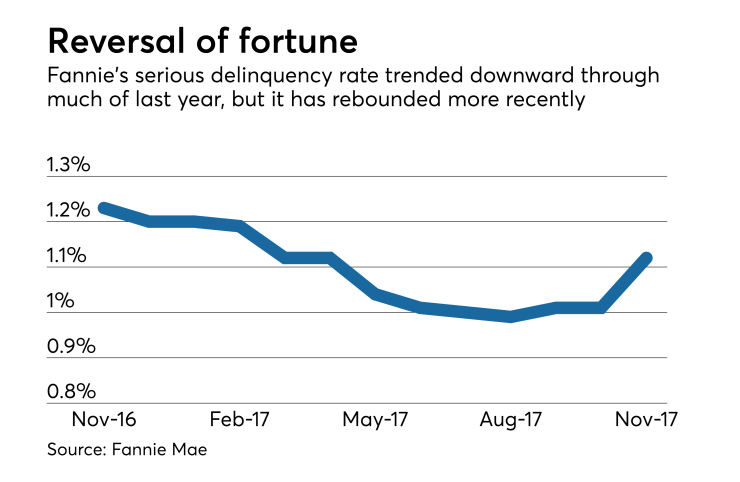

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior, according to the agency's latest monthly report.

The share of single-family loans with serious delinquencies was 1.12% in November 2017, up from 1.01% the previous month. In November 2016, Fannie's serious delinquency rate was 1.23%.

For loans originated in 2004 or earlier, the serious delinquency rate in November 2017 was 3.05%, up from 2.82% in October 2017 and November 2016.

The serious delinquency rate for loans originated between 2005 and 2008 was 6.26%, up from 5.91% in October 2017, but down from 6.47% in November 2016.

Loans originated between 2009 and 2017 had a serious delinquency rate of 0.42%, up from 0.35% in November 2016 and from 0.33% in October 2017.

Fannie's serious delinquency rate rose compared to the previous month regardless of whether loans had credit protection from mortgage insurance or were referenced by credit risk transfer deals. But only credit risk transfer deal loans registered higher serious delinquency rates than in November 2016.

Credit risk transfer deal loans had a serious delinquency rate of 0.27% in November 2017, up from 0.18% the previous month and 0.15% in November 2016.

Mortgages with primary mortgage insurance had a 1.76% serious delinquency rate in November 2017, up from 1.06% the previous month, but down from 2.21% in November 2016.

Loans that didn't have any credit enhancement had a serious delinquency rate of 1.17% in November 2017. This marked an increase from 1.06% the previous month, but was lower than in November 2016, when the serious delinquency rate was 1.19%.