-

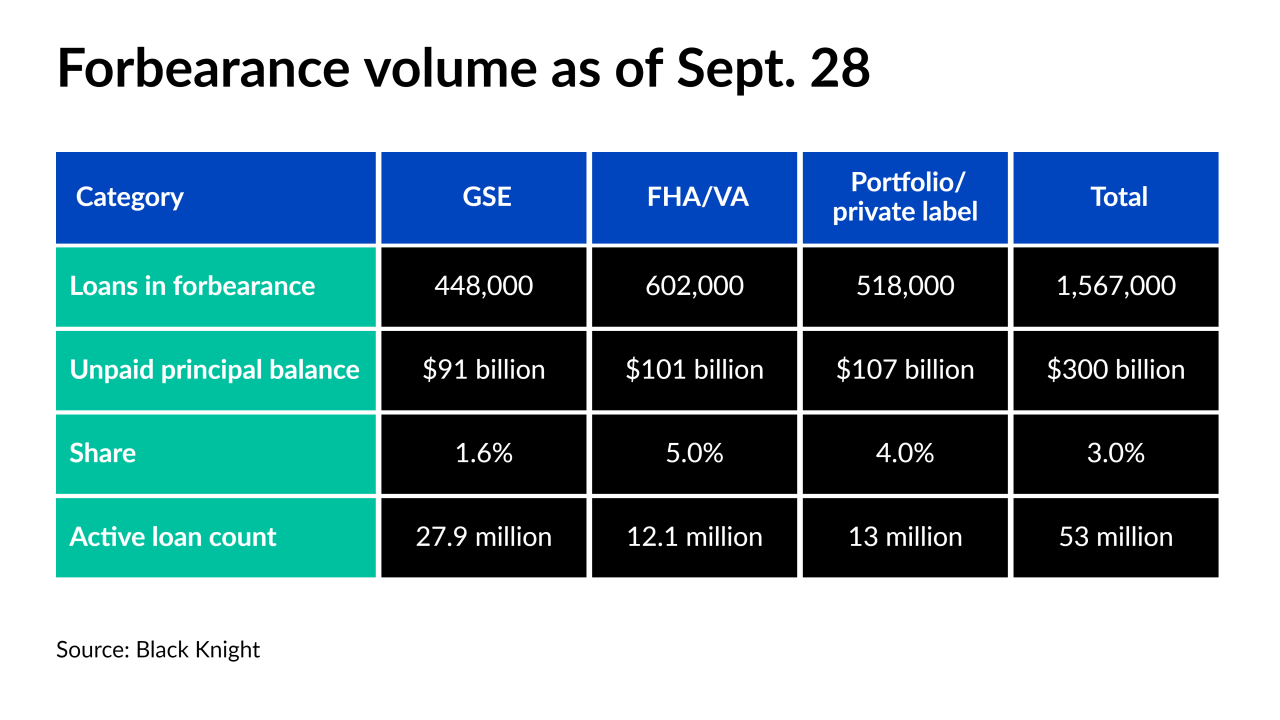

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

September 30 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The need to size up the impact of hurricanes and pollution is increasing and current measures aren’t as precise as credit or rate models, according to the Research Institute for Housing America.

September 23 -

The decline from 4.4% in July and 6.88% a year ago brings the number much closer to pre-pandemic norms, but foreclosure starts are a different story.

September 22 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

About 400,000 plans are scheduled to drop out in September based on the limits afforded by the CARES Act.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

More than 500,000 houses were potentially affected by this type of damage from the more recent storm, which was the second-most intense storm in Louisiana’s history.

August 31 -

Distressed homeowners who first took advantage of deferrals in March of last year will either start repayment or look for new solutions in September.

August 30 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27 -

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

Marked declines in loans that have had relatively higher levels of pandemic-related distress reinforced other indicators suggesting the market could normalize if infection rates remain contained.

August 19 -

But 45% of the top 100 counties still have an above-average likelihood that borrowers won’t make their payments on these business-purpose loans, RealtyTrac said.

August 18 -

The move adds to signs that the broader restart of foreclosures won’t get fully underway until 2022.

August 17 -

The agency developed measures taking effect Aug. 31 that, among other things, will allow lenders to prioritize foreclosures of the most impaired loans and then focus on modifying salvageable ones.

August 11 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27