Mortgage default risk for single-family rental properties decreased 16% in the first half of 2021 when compared to the previous six months, according to RealtyTrac. But in 45 of the nation's top 100 counties, there is still an above-average chance these loans won’t perform.

June's average Default Risk Score was 36.7, compared with 43.9 in January. The score is calculated on three criteria measured at the county level: the percentage of rental properties, the relative unemployment rate and the loan-to-value ratio for homes that have a mortgage.

"But even with the decrease, the risk for default among these rental property owners is still very real, especially in California and Florida," he said in a press release.

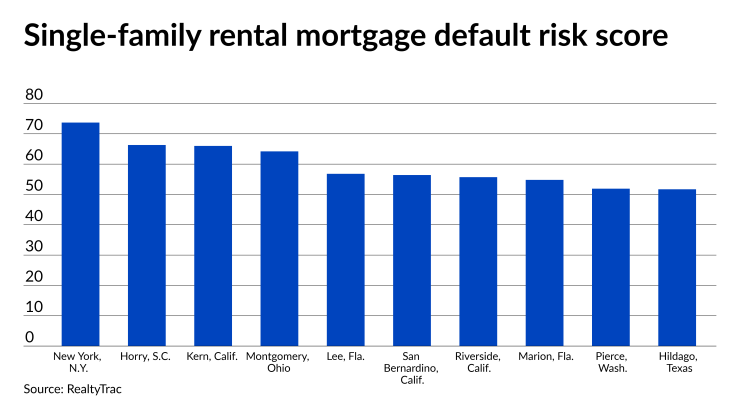

Of the 10 counties with the highest risk scores as of June, three were in California and two in Florida, The Sunshine State also contains eight of the 45 counties in the nation with above-average risk. Seven of those counties are in California.

But the county with the highest DRS is New York (Manhattan), which has a risk score of 73.7, followed by Horry in South Carolina at 66.3 and Kern in California at 66.

At the other end of the scale is Utah's Salt Lake County, with a 6.7 score, followed by Gwinnett in Georgia at 16.6 and Travis County, Texas, at 18.8.

"As the economy recovers, it makes sense to see a lower default risk for rental property owners," Sharga said. "But many landlords still need financial relief after the government's 18-month eviction ban, so it's critical for state governments to begin distributing the $45 billion that

Almost 90% of single-family rental homes are owned