COVID-related forbearances declined slightly in the final week of August, as the industry prepares to deal with several hundred thousand plans that are slated to expire in September.

For the period from Aug. 25 to Aug. 31, the volume of forborne homeowners fell by 53,000, according to data provided by Black Knight. Of that total, 23,000 held loans sponsored by the Federal Housing Administration or Veterans Affairs, while 20,000 were backed by government-sponsored enterprises Fannie Mae and Freddie Mac. An additional 10,000 portfolio-held and private-label mortgages also dropped out of forborne status. The reduction comes after a slight mid-month increase of 12,000 one week earlier.

“The week’s decline was primarily due to typical month-end roll-offs, and, with more than 80,000 mortgages still set for August 2021 expirations, additional month-end roll-offs are likely to be observed in next week’s report as well,” said Andy Walden, Black Knight’s vice president of market research, an an emailed response.

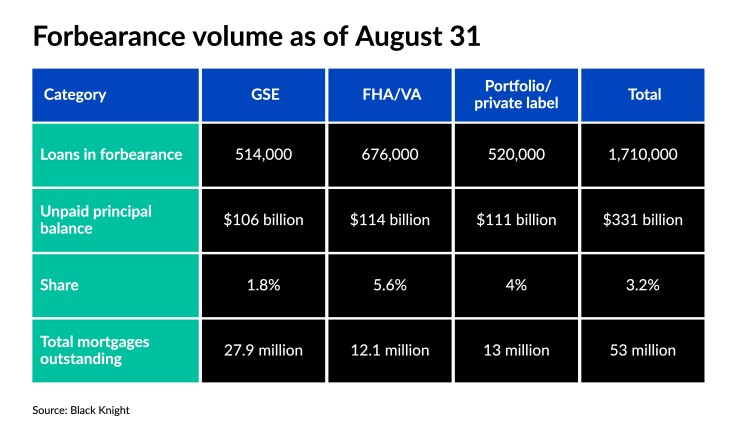

At the end of August, 1.71 million borrowers remained in COVID-related forbearance plans, falling 9% — approximately 168,000 — from one month earlier. The number represents 3.2% of mortgage volume, compared to 3.3% the previous week. About 5.6% of FHA/VA, 1.8% of GSE and 4% of portfolio-held and privately securitized loans were in active forbearance plans.

September will usher in the end of CARES Act relief for many homeowners based on the legislation’s allowable forbearance term lengths. That has the mortgage industry bracing for waves of exits. Protections introduced in March 2020 allowed homeowners to enter forbearance plans for up to 18 months, no questions asked. Of 629,000 plans slated to be reviewed for extension and removal in September, nearly 400,000 of those are set to reach their final plan expirations based on current limits, according to Walden.

“Significant volume declines could be seen in coming weeks as those plans reach their final expirations and exiting borrowers return to making mortgage payments in October,” he noted in a blog post.

While the vast majority of homeowners who left plans early are currently performing, many of those borrowers set to drop out will likely require further assistance.

“It's fair to expect those borrowers who require the full allowable forbearance period to face increased challenges in returning to making their mortgage payments,” Walden said.

The unpaid balance of loans in forbearance totaled $331 billion, down 2.7% from $342 billion the prior week. FHA/VA mortgages backed by Ginnie Mae accounted for $114 billion of the total, decreasing from $118 billion, while GSE unpaid balances came out to $106 billion, dropping from $110 billion. Portfolio and private-label-securities mortgages in forbearance had $111 billion in unpaid balance compared to $114 billion a week earlier.

With the high number of plans set to roll off beginning in September, heightened servicing activity is likely to follow for several months.

“Broadly speaking, forbearance volumes should begin to decline noticeably over the next few months as early entrants’ plans expire, with the vast majority of active plans expiring by the middle of 2022,” Walden said.

— Paul Centopani contributed reporting to this story