-

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

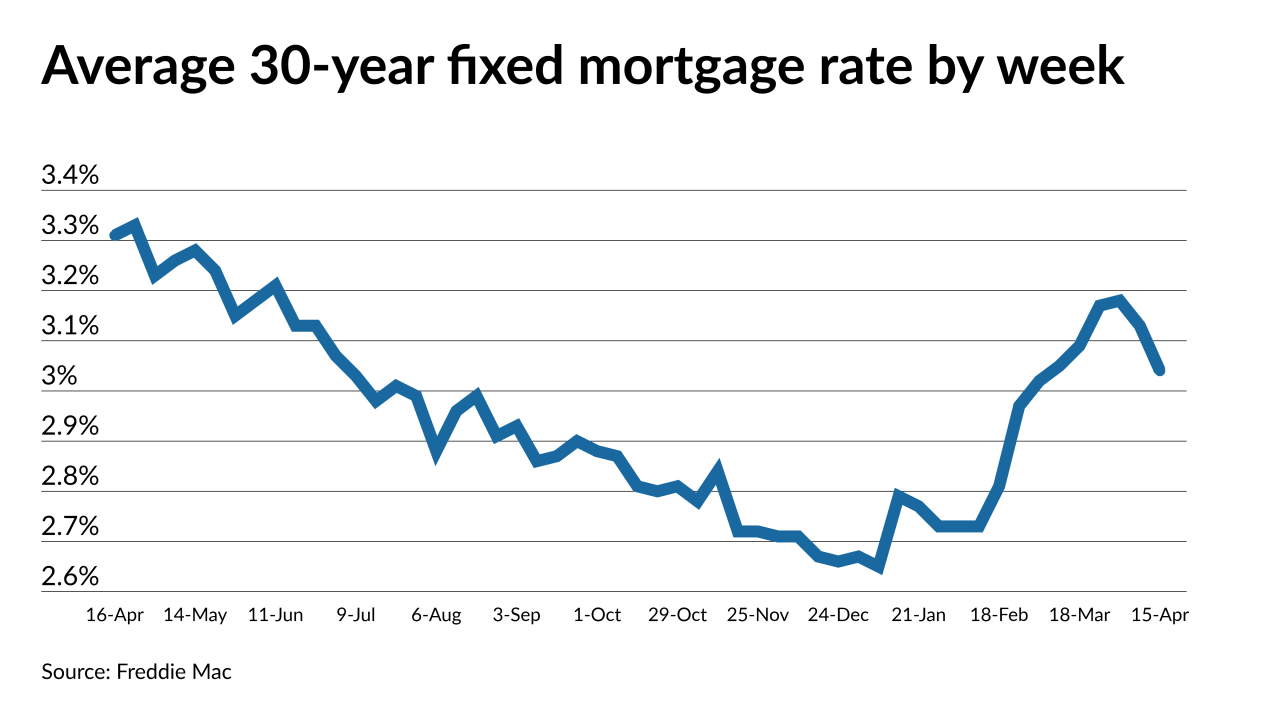

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24