-

COVID-19 concerns, inflation hold back actions that might change current patterns.

September 16 -

Effects of major economic announcements this summer have had little impact on the lending market, with averages remaining under 3% since July.

September 9 -

The 30-year average has remained below 3% for two months.

September 2 -

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

An equal split of refinance and purchase rate locks occurred during July, helped by elimination of the adverse market fee, Black Knight said.

August 9 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

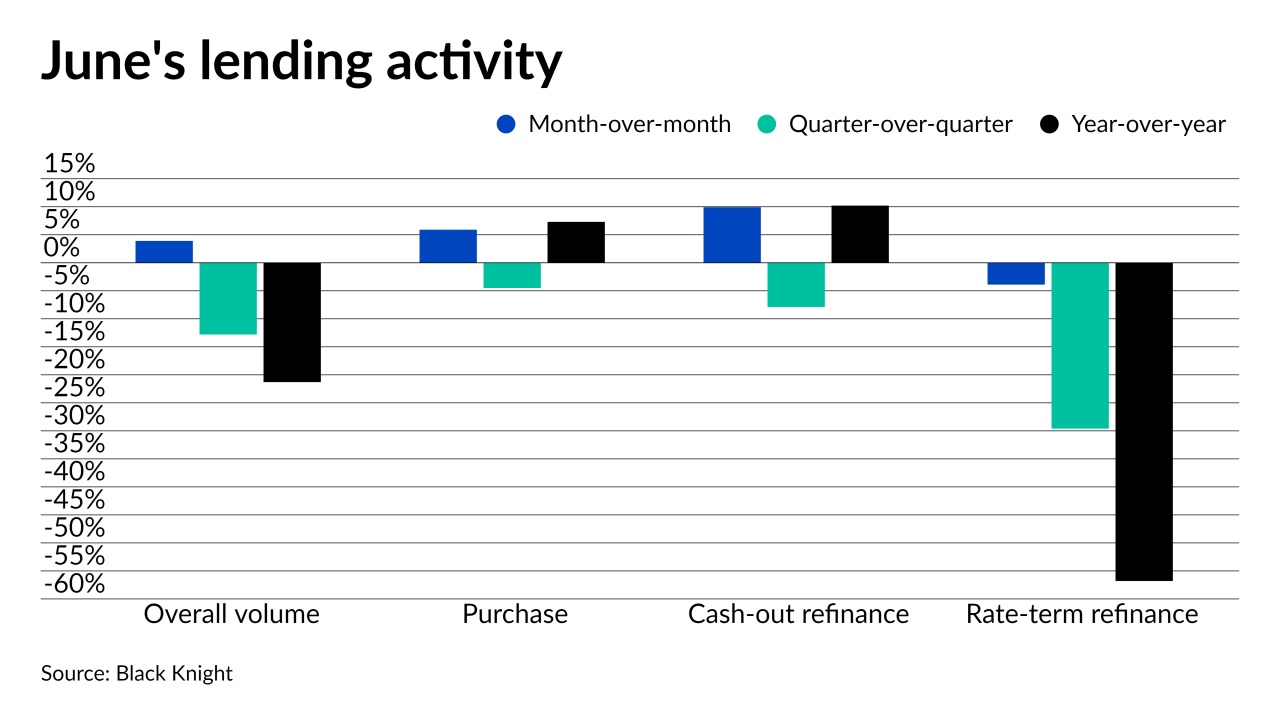

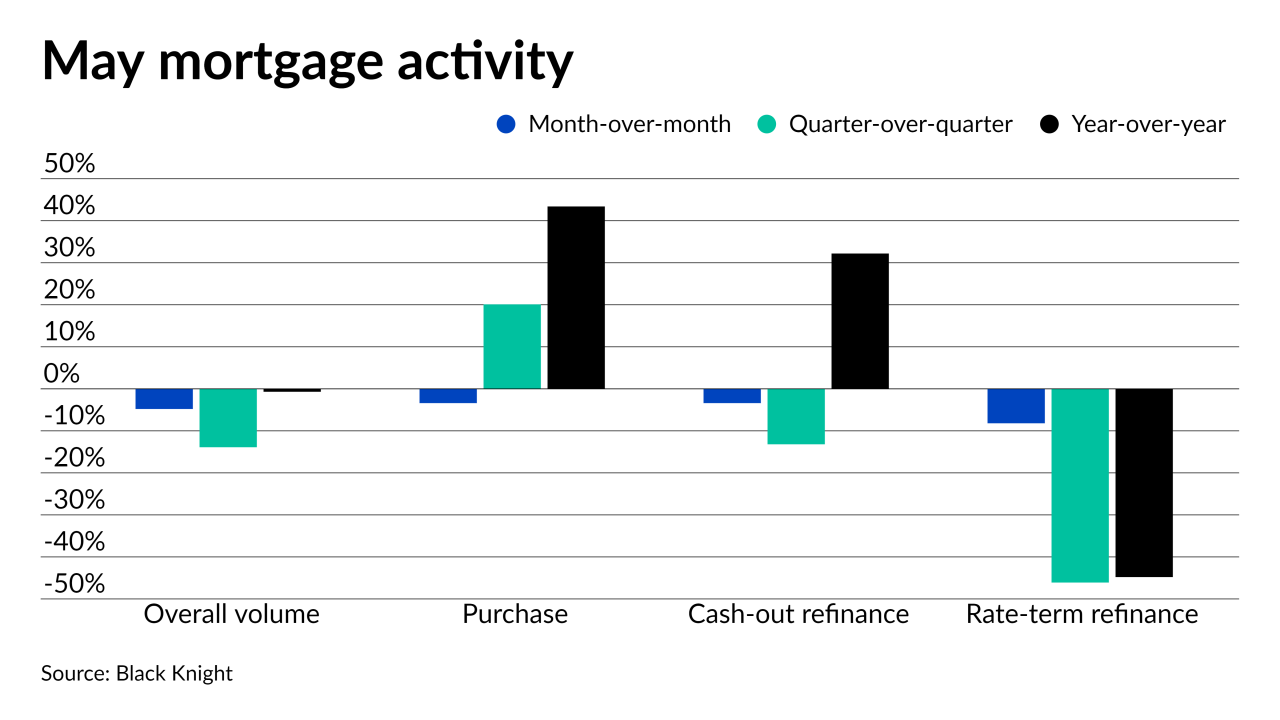

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30