Mortgage rates moved little in

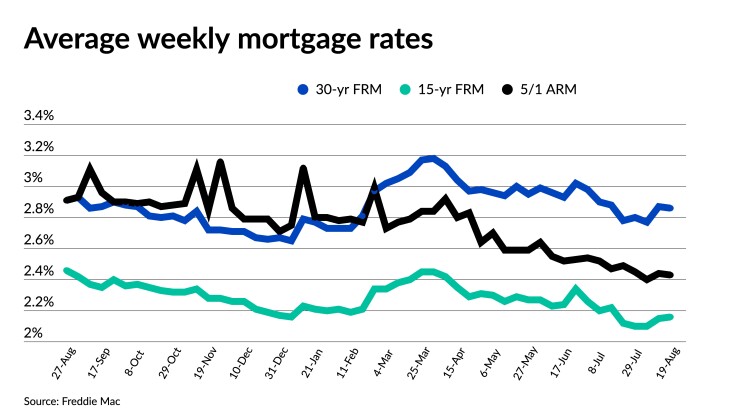

The 30-year fixed-rate mortgage nudged downward for the weekly period ending August 19, settling at 2.86%, according to Freddie Mac’s Primary Mortgage Market Survey. A week earlier, the average came in at 2.87%, and one year ago, the 30-year fixed-rate stood at 2.99%.

The latest

“These figures were released after the Federal Reserve last met and issued an official statement, so investors are anxiously awaiting signals for how, or whether, these reports could cause the Fed to rethink their perceived plans to tighten monetary policy by the end of the year,” Speakman said in a statement.

Meeting minutes from the

“With respect to the effects of the pandemic, several participants indicated that they would adjust their views on the appropriate path of asset purchases if the economic effects of new strains of the virus turned out to be notably worse than currently anticipated and significantly hindered progress toward the committee’s goals,” the committee said.

The housing market, though, continues to maintain the trajectory of its momentum, propelled this year by home buyers hoping to take advantage of favorable rates. The demand has resulted in limited supply and record-high price increases of both

“While there is strong latent demand, low supply has caused prices to rise, as shortages restrict the amount of sales activity that otherwise would occur,” said Sam Khater, Freddie Mac chief economist.

Other interest-rate types also showed minimal movement over the past week. The 15-year fixed-rate mortgage rose one basis point to 2.16%, up from 2.15%. In the same weekly period a year ago, the 15-year rate came in at 2.54%.

The 5-year Treasury-indexed adjustable-rate mortgage edged downward by one basis point to 2.43%, compared to 2.44% a week earlier. One year ago, the rate stood at 2.91%.