In spite of 14 million high-quality refinance candidates, mortgage origination volume hit a 13-month low in May, according to Black Knight.

In the shadow of

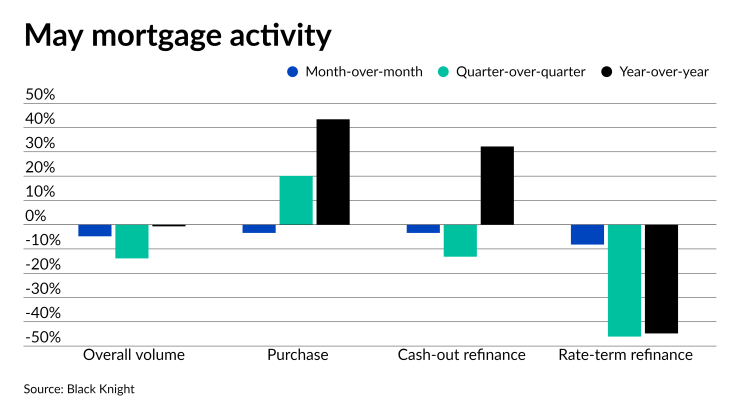

Annually, overall lending activity dwindled by 0.7% as rate-and-terms decreased 44.8% while purchases and cash-out refis grew by 43.4% and 32.2%, respectively. The

“The dip in refinance locks seems to have more to do

The

Of the 10 largest metropolitan areas by origination volume in May, only Seattle experienced origination growth from April, rising 1.4%. Los Angeles held the top spot in market share with 5.2% of the national total, as its activity ticked down 5.8% month-over-month. The Washington D.C. statistical area accounted for 4.4% while fading 1.7% from April. The New York metro came next at 4.3% but individual originations declined 9.1% monthly. Los Angeles, Phoenix and San Francisco had majority refinance shares.