The mortgage rates that

The Mortgage Bankers Association’s Market Composite Index — a measure of loan application volume — dropped 5.1%

Refinance applications declined for the fifth week in a row, dropping 30% over the last 10-week period and sitting 20.4% lower than year-ago levels. While purchase volume dipped in the near term, it was still 50.8% higher than the year before.

“The rapidly recovering economy and

The adjustable-rate mortgage share of activity rose again to 3.7% from 3.4% the week earlier.

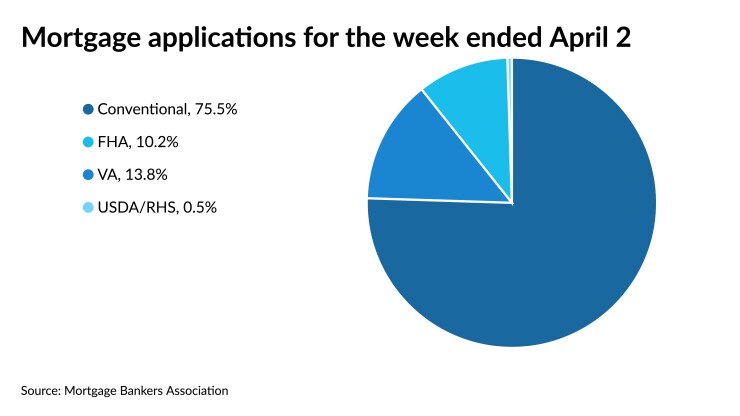

By product type, Federal Housing Administration mortgages made up 10.2% of this week's applications, down from 11.3% week-over-week. Veterans Affairs loans jumped to 13.8% from 10.3% while the U.S. Department of Agriculture/Rural Housing Service share edged up to 0.5% from 0.4%.

The average contract interest rates rose across all loan types. The 30-year fixed-rate mortgages with conforming loan balances — $548,250 or less — went to 3.36% from 3.33%. Jumbo loans — those over $548,250 in value — went to 3.41% from 3.34% and FHA-insured mortgages went to 3.36% from 3.29%. The rate for 15-year FRMs increased to 2.74% from 2.71% and 5/1 ARMs went to 2.92% from 2.85%, with points rising to 0.46 from 0.4.