-

Notes A, B and C benefit from credit enhancement amounting to 33.3%, 16.2% and 7.0%, and the deal's capital structure will repay investors on a combined pro-rata and sequential basis.

May 7 -

Price growth is decelerating but still driving historic home equity gains for owners and widening the gap between the haves and have-nots in housing, ICE finds.

May 6 -

Overall, the loans also have a weighted average (WA) FICO score of 742, an original cumulative loan-to-value ratio of 77.9%, and debt-to-income ratio of 37.5%.

December 12 -

Originators funded 72.6% of the loans in 2023, while 16.7% of the loans were funded in 2022 and originators funded the rest between 2021 and 2018.

December 7 -

Though home mortgage issuance has slumped in line with originations, new potential bank capital rules and increased consumer debt consolidation could boost activity for these two subsets in the secondary market.

October 23 -

Notes will be repaid through a modified sequential structure, which calls for the A-1 and M-1 through M-3 classes to receive principal on a pro-rata basis.

June 22 -

Among the nonperforming assets 44.01% are either in foreclosure or referred for foreclosure; 19.32% are in default; 7.17% are liquidated and 1.75% are in bankruptcy.

June 15 -

While first-quarter profits were up considerably, CEO Michael Nierenberg said the company will offer more products to counter market conditions that are “only going to get worse.”

May 3 -

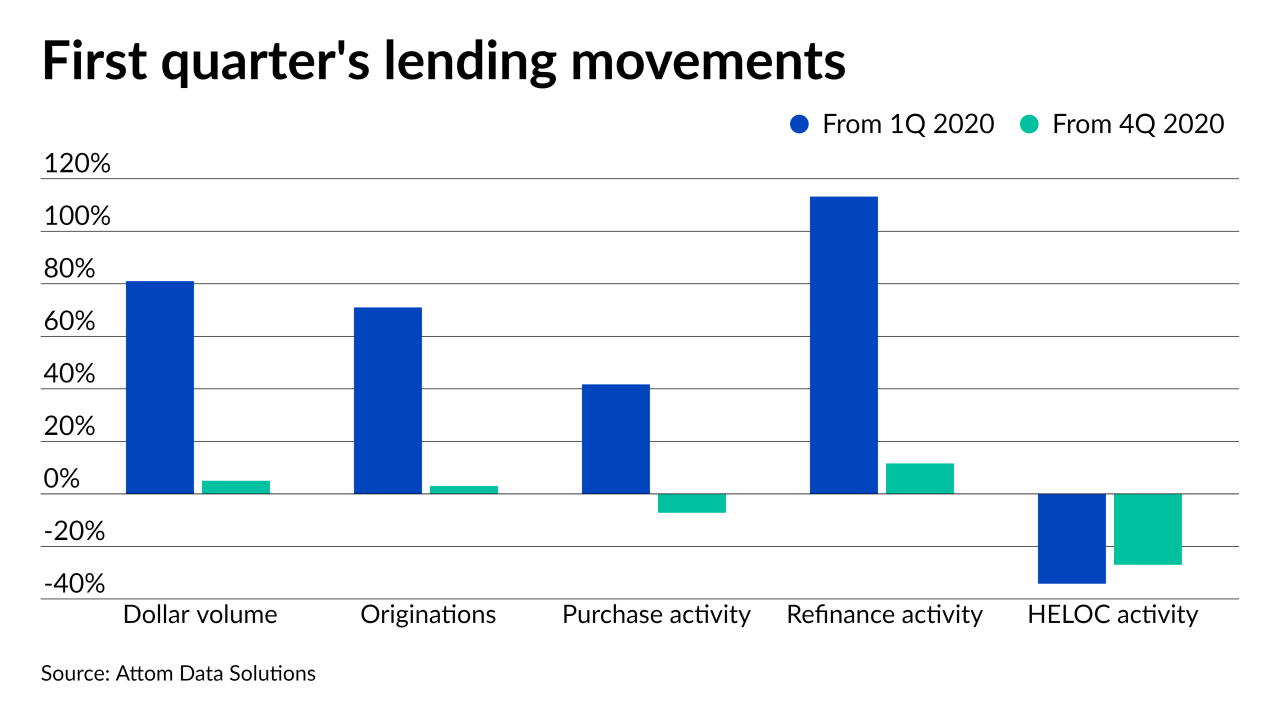

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

A majority of the loans are also junior-lien obligations, according to a presale report.

February 22 -

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

New securitizations backed by Home Equity Conversion Mortgages fell 14% in 2019 as interest in originating proprietary products increased, according to New View Advisors’ analysis of public and private data.

January 6 -

The SoFi co-founder said Figure Technologies is working with national banks to employ its distributed ledger tech for loan originations.

December 13 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17