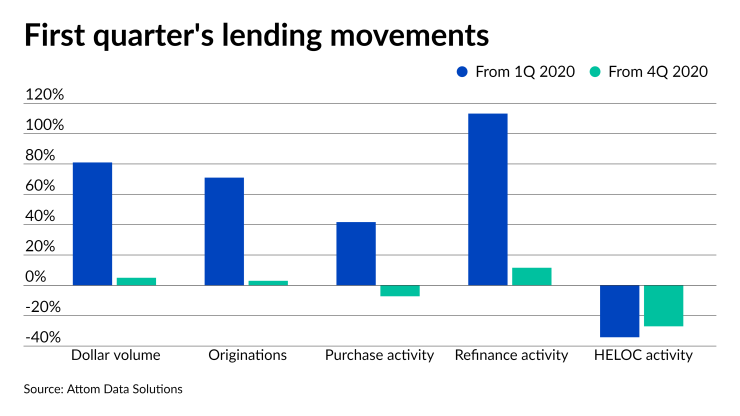

In an atypical opening quarter, total mortgage originations increased from the fourth quarter for the first time since 2009, according to Attom Data Solutions.

Driven by borrowers refinancing with low interest rates

Refis jumped 11.6% quarterly and 113.2% annually, totaling 2.55 million loans and the highest since 3Q 2003. Purchase originations took a short-term step back, accounting for about 1.04 million loans. It represented a quarterly drop of 7.2% while rising 41.7%

"Homeowners lined up to refinance their loans in ever-growing numbers during the first quarter of 2021, making for a highly unusual quarterly increase in total lending activity for that time of year,” Todd Teta, chief product officer at Attom Data Solutions, said in the Residential Property Mortgage Origination Report. “The home mortgage industry almost always slows down in winter, but not this year because of so many homeowners hopping on super-low interest rates to reduce their monthly payments."

Among housing markets with populations over 1 million, Buffalo, N.Y., had the largest jump in refi activity, increasing 55% quarter-over-quarter. The gains of 37.2% in Las Vegas and 31.8% in Milwaukee followed. Pittsburgh went against the national refi trend and dropped 23.1% quarterly, edging out falls of 16.6% in Houston and 14.6% in St. Louis.

The largest quarterly increases in purchase activity came in Orlando, Fla., ( 29%), Miami (24.5%) and Baltimore (24%). Meanwhile, Buffalo’s purchase lending dropped 65.1% from the fourth quarter, followed by 56.2% in Atlanta and 34.4% in St. Louis.

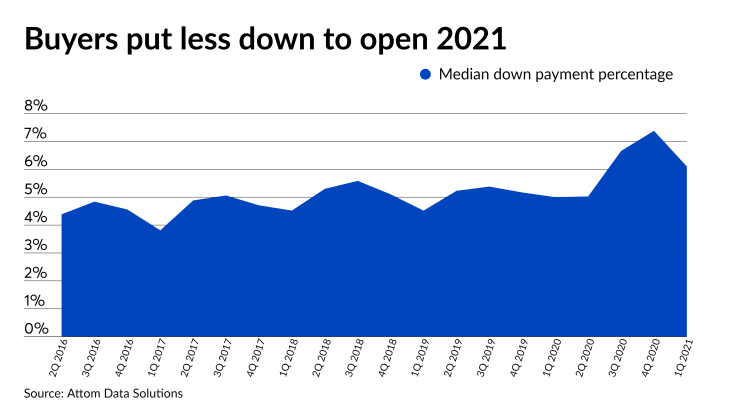

The median down payment went to $18,700, down from $23,250 quarterly but up from $13,250 annually. The down payment percentage of the median home price followed the same pattern, going to 6.1% from 7.4% the previous quarter and from 5% the year prior. It’s the first time that the down payment percentage fell in the last four quarters.

“Lenders issued more residential mortgages than in any first-quarter period since 2006 and lenders required smaller down payments for those loans,” Teta told National Mortgage News. “Both were signs that mortgage money was readily available at some of the best interest rates ever.”