-

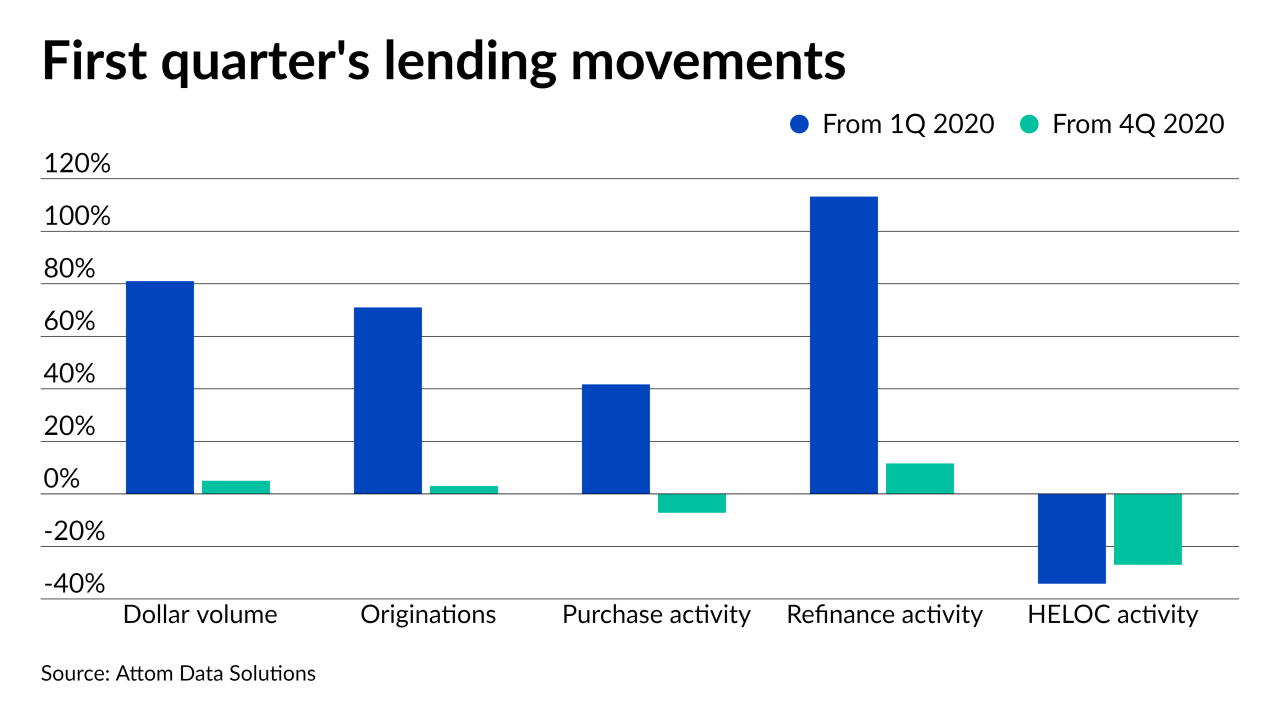

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 27

-

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

The Trump administration is cracking down on national affordable housing programs because of concern over growing risk to the government's almost $1.3 trillion portfolio of federally insured mortgages.

April 22 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

In its latest effort to reach first time home buyers, Freddie Mac is launching a new 3% down payment program that casts aside a number of restrictions in its existing low down payment offerings.

May 2 -

Acting commissioner Dana Wade said the agency is "vigilantly" watching whether it needs to take action on PACE assessments placed on mortgages after they are endorsed by the agency.

February 27