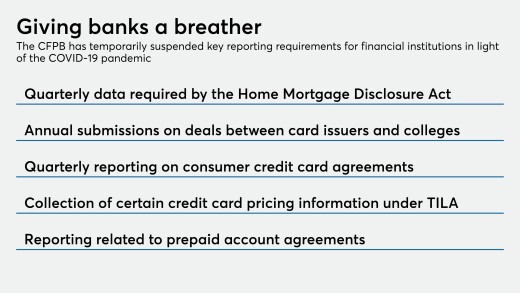

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

The company once again lowered its outlook for quarterly revenue growth, saying the coronavirus pandemic has led to a sharp decline in cardholders’ overseas spending.

Businesses are struggling to adapt to remote work, according to a new survey by Arizent, the parent company of Employee Benefit News.

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

There isn’t a better time than now to review your employee healthcare and wellness benefits.

-

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

The company once again lowered its outlook for quarterly revenue growth, saying the coronavirus pandemic has led to a sharp decline in cardholders’ overseas spending.

March 30 -

Businesses are struggling to adapt to remote work, according to a new survey by Arizent, the parent company of Employee Benefit News.

March 30 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

March 30 -

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

March 29 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27