-

A House subcommittee hearing discussing the future of the government-sponsored enterprises, noted both are still severely undercapitalized.

February 12 -

Adjustments related to higher credit risk weights for new acquisitions and rate shifts offset increases in the government-sponsored enterprise's core earnings.

February 11 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

January 14 -

The largest bank in the country bulked up its reserves by $2.2 billion for potential credit hits from the Apple card portfolio, which JPMorgan is taking over from Goldman Sachs.

January 13 -

The buyout firm gathered $43 billion during the three months through September. KKR's Global Atlantic insurance unit, collateralized loan obligation issuance and its high grade and asset-based finance groups fueled the credit results.

November 7 -

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

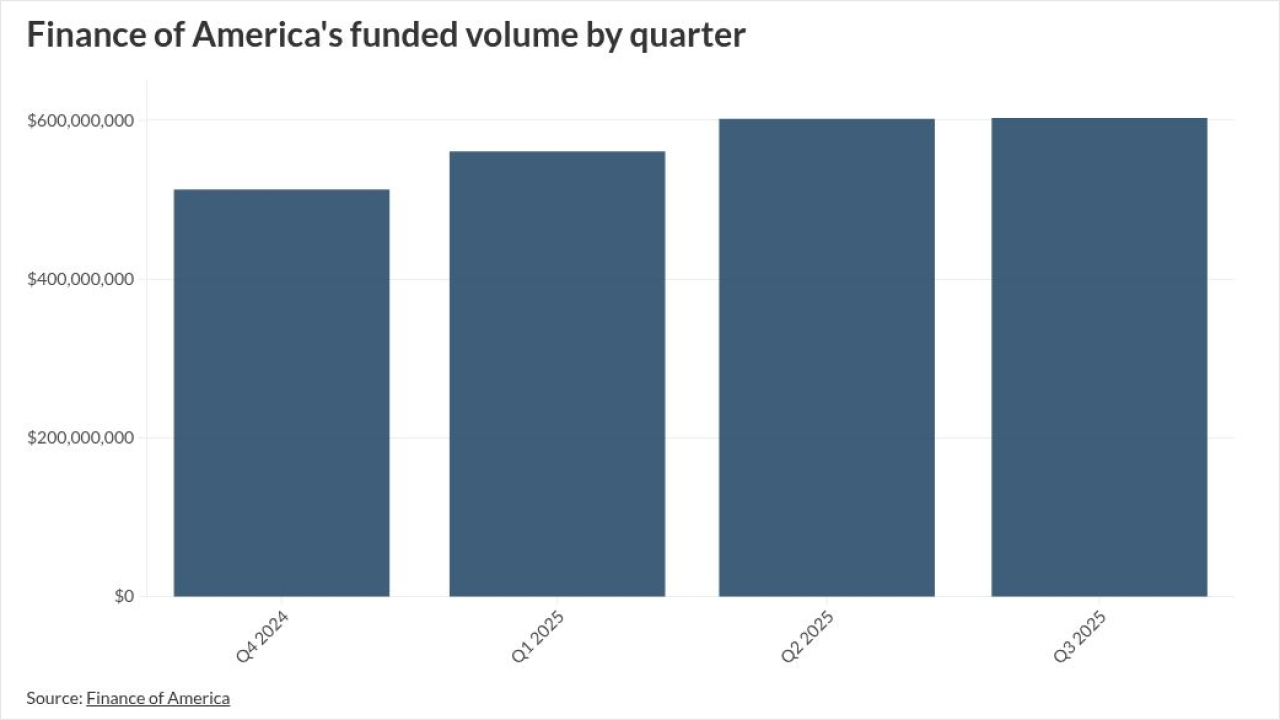

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

The buy now/pay later firm, which reports earnings Thursday, has inked deals with Worldpay to expand potential borrowers and with New York Life to obtain more capital for future lending.

November 3 -

The Tacoma, Washington-based bank, which has completed two mergers since 2023, said Thursday that it will buy back up to $700 million of its own shares over the next year.

October 31 -

Top SBA lenders are warning about the impact of a prolonged shutdown. NewtekOne skipped providing fourth-quarter guidance after its CEO said the situation was too cloudy to forecast.

October 30 -

The North Carolina bank is the latest lender impacted by the bankruptcy of U.S. auto parts maker First Brands. First Citizens executives said credit was in good shape overall.

October 23 -

In a tough quarter for the auto industry, the Detroit-based lender posted earnings that sped past Wall Street's expectations.

October 17 -

The Buffalo-based bank said Thursday that the paring of its CRE loan book, which has nearly halved in volume over the last three years, may be near its inflection point.

October 16 -

The San Francisco-based banking giant reported a 9% annual jump in quarterly profits. It also made official its appointment of CEO Charlie Scharf as chairman.

October 14 -

The company's advisers are sounding out lenders for new financing, which could be structured as a so-called debtor-in-possession loan to fund continuing operations if it begins the Chapter 11 process.

September 23 -

As President Trump calls for scrapping quarterly earnings reports and switching to a six-month schedule, industry observers wonder whether the time saved would be worth the potential loss of transparency.

September 16 -

The Canadian bank said it will take at least a year to hit an inflection point in U.S. loan growth. It has been shedding assets in an effort to free up space for growth in more promising business lines.

August 28 -

The correspondent giant, whose earnings have trended positively in recent quarters despite market headwinds, has made several debt moves this year.

August 8 -

The student loan giant fell far short of Wall Street's expectations, but its leaders say President Trump's "Big Beautiful Bill" is likely to bring it billions of dollars in new business.

July 25 -

Bank earnings have been largely positive in the second quarter despite concerns that tariffs would increase inflation and stifle economic activity. Payment divisions at banks reaped the rewards, too.

July 21