(Bloomberg) -- The giants of corporate America from Pfizer Inc. to Alphabet Inc. are borrowing in euros like never before as the anxiety triggered by President Donald Trump's tariff threats pushes them to hunt for alternative funding avenues in case their home market freezes up.

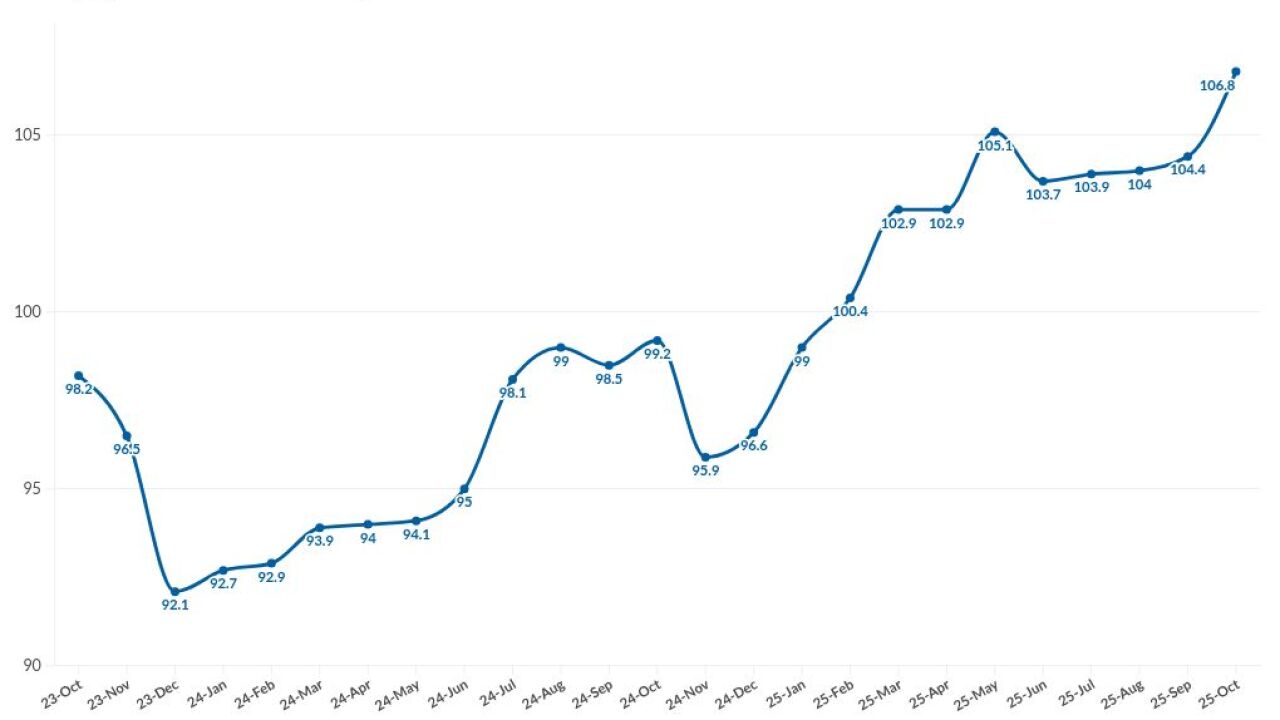

A record number of these so-called reverse Yankee deals have been sold this year at a total value of more than €83 billion ($94 billion), up 35% on 2024, according to data compiled by Bloomberg. That's nearly 14% of overall euro corporate issuance, the data shows.

This all comes after Trump's tariff pronouncements sparked market mayhem in April. On Friday, Moody's downgraded its credit rating on the US, stripping the world's largest economy of its last triple-A rank.

For decades the US corporate bond market has been the go-to destination for money managers. But early signs are emerging that Trump-induced dollar volatility, inflated Treasury yields and fears about the country's debt burden are fueling a gradual reweighting toward the Old Continent. That would delight euro zone leaders desperate to bolster the bloc's capital markets.

"The increasing depth of the European market is a massive factor," according to Andrew Menzies, head of debt capital markets at Societe Generale SA. Chunky deals and big issuance days used to be a feature in the US, he says, but "you see it now in Europe as well, as typified by the supply in recent days being taken down relatively easily."

The US remains by far the most liquid market, with nearly $7.5 trillion of bonds in Bloomberg's main index of blue-chip US company debt, and Europe is the next biggest player with €2.85 trillion of bonds. But recent gains by the euro against the dollar are adding to the bullishness.

US companies now account for more than a fifth of a Bloomberg index of euro corporate bonds. While this isn't unprecedented — a negative deposit rate in Europe attracted many reverse Yankees in the easy money era — the percentage has increased since the start of the year to 21.9%.

"You cannot be faulted as a chief financial officer or treasurer to be accessing euros right now," says Fabianna Del Canto, co-head of EMEA capital markets at Mitsubishi UFJ Financial Group Inc. "It's an attractive relative cost, with low coupons in a stable environment versus risking the unknown in the US."

"You look at screens sometimes and you don't know if it's the dollar market or the euro market in terms of the names announcing transactions and the amount of cross border activity," she adds.

Diverging interest rates — the basis for corporate borrowing costs — play a huge part in euro bonds' attractiveness, particularly for companies with operations in Europe who don't have to exchange back into dollars. The average yield on an index of US corporate bonds is quoted at 5.3%, and the European equivalent is 3.18%. Last month that difference was the widest in three years.

Google's parent Alphabet raised €6.75 billion the day after raising $5 billion in the US. It will pay a coupon of 3.375% for its euro bond maturing in 2037, and 4.5% for its dollar 2035 maturity.

"Continuously high Treasury yields, driven by high US debt and deficits, means high borrowing costs for US households and companies," says Kaspar Hense, a fixed income portfolio manager at RBC BlueBay.

With international investments into the US slowing, companies will need to find extra funding abroad. This could mean yet more reverse Yankees, Hense adds.

Euro Bounce

All of this could become more pronounced as traders become confident that the euro's rally has further to run, with demand for options that target a stronger euro around its highest point for the year.

The surge in inflows from the US has helped drive overall bond issuance run out of Europe to pass the €1 trillion mark in record time.

It helps that investors are able to use reverse Yankees to get access to blue-chip US corporates without having direct exposure to the dollar and Treasury movements. That's ideal for those who expect the country to avoid a recession but still don't want to deal with the day-to-day volatility.

Some caution that the Trump turbulence may just end up being exported to Europe. The spike in reverse Yankees means the euro credit market will likely be more sensitive to US politics, Bank of America strategists led by Barnaby Martin wrote in a note earlier this month.

For others, they still offer some value. "I prefer reverse Yankees to US dollar-denominated bonds because I'd rather own German Bunds than US Treasuries," says Gordon Shannon, a portfolio manager at TwentyFour Asset Management. "For now I think the govvies might be the biggest sources of volatility in corporate bonds."

Elsewhere in credit:

Private Equity Is Troubled, $1 Trillion Kuwait Fund Warns

Bond Sales Run Out of Europe Exceed €1 Trillion in Record Time

Sixth Street's Easterly Sees Private Credit 'Complacency'

Morningstar CEO Sees Private Credit as Avenue to Take On Rivals

More stories like this are available on bloomberg.com