Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

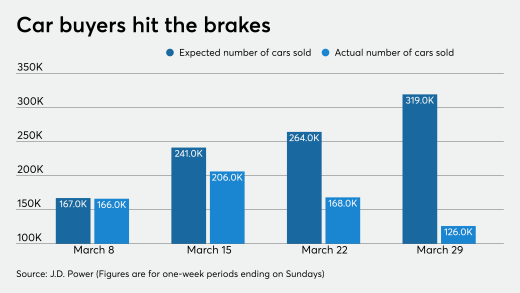

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

Michael Burry, the doctor-turned-investor who famously bet against mortgage securities before the 2008 financial crisis, has taken to Twitter with a controversial message: lockdowns intended to contain the coronavirus pandemic are worse than the disease itself.

Ford is the second automaker to have its dealer financing securitizations placed on a negative credit watch due to the impact of the COVID-19 outbreak.

-

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

April 9 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

Michael Burry, the doctor-turned-investor who famously bet against mortgage securities before the 2008 financial crisis, has taken to Twitter with a controversial message: lockdowns intended to contain the coronavirus pandemic are worse than the disease itself.

April 8